Top Stories

Czech Inflation Slows, Services Prices Support Rate Stability

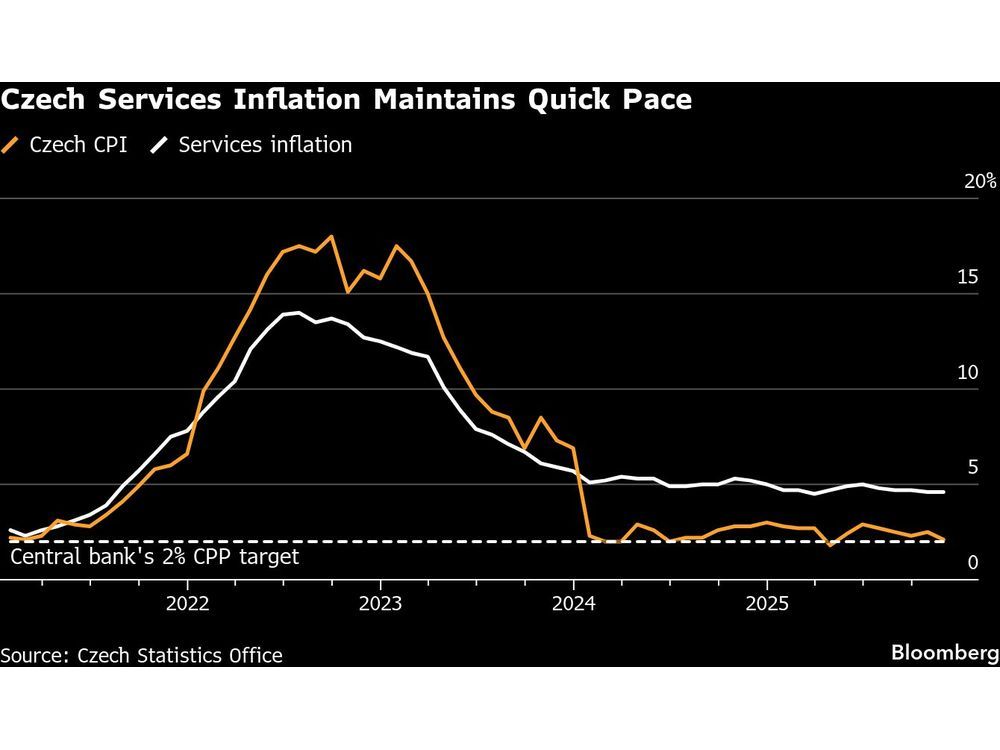

Czech inflation experienced a slower-than-expected decline in November, reinforcing a cautious approach from the Czech National Bank regarding interest rates. According to a preliminary report from the Czech statistics office, consumer prices rose by just 2.1% compared to the previous year, falling short of the 2.5% median estimate from a Bloomberg survey and the central bank’s own projection of 2.2% for the month.

The moderation in overall inflation was largely driven by volatile food and energy prices, which have fluctuated significantly in recent months. In contrast, services inflation remained stubbornly high at 4.6%, a key factor contributing to the central bank’s cautious stance on monetary policy.

Policymakers in Prague have opted to maintain interest rates unchanged during their last four meetings, citing persistent inflation within the services sector and rapid wage growth as major deterrents to further rate cuts. “We don’t expect the preliminary November inflation data to change the bank board’s cautious stance on interest rates,” said Radomir Jac, chief economist at Generali Investments CEE. He added that the Czech National Bank is unlikely to lower rates further, suggesting that the current repo rate of 3.5% might already represent its lowest point.

In a related release, the statistics office reported that the average nominal wage increased by 7.1% in the third quarter, slightly surpassing the central bank’s forecasts. Real wage growth, reported at 4.5%, has been instrumental in bolstering household consumption, which has emerged as a significant driver of economic growth this year.

The next monetary policy meeting of the Czech National Bank is scheduled for December 18, 2023, where further discussions on the current economic landscape and inflation pressures are anticipated. Some central bank officials have indicated that maintaining a tight monetary policy remains essential in light of ongoing economic indicators.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169