Business

Silver and Copper Surge as Gold Loses Its Luster Heading into 2026

Silver and copper have overtaken gold as the preferred metals for traders as they prepare for significant price surges in 2026. Both institutional and retail investors are positioning themselves for unprecedented rallies, with silver’s price nearly doubling this year. Much of this increase has occurred in the last two months, largely driven by a historic supply squeeze in the London market, where demand from India and silver-backed exchange-traded funds (ETFs) has surged.

While the immediate supply crunch has eased somewhat due to increased shipments to London vaults, other markets are still facing tight supply, particularly in China, where inventories have reached decade lows. According to Ed Meir, an analyst at Marex Group Inc., the volatility in silver has been particularly notable. He stated, “If you look at the chart, there’s been a steeper parabolic move up than seen in previous rallies. The buying is much more concentrated and in a much shorter time frame.”

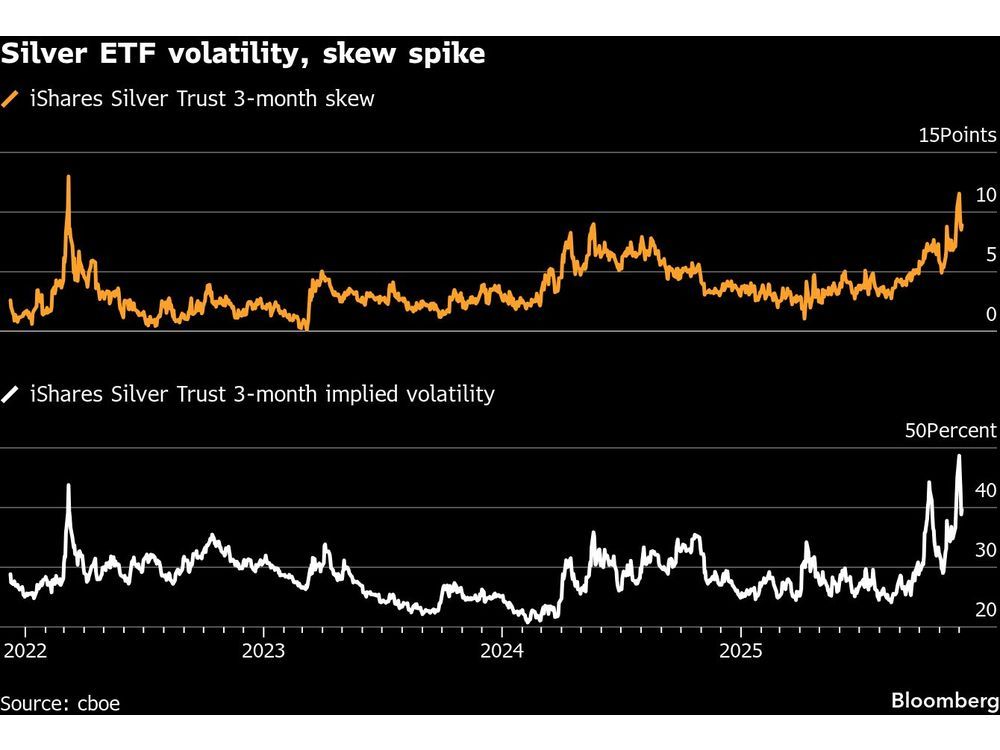

Over the past several weeks, silver has outperformed gold significantly. Since gold bullion reached a record high on October 20, 2023, its price has largely stabilized, while silver has risen more than 11% and set new records. Copper has also seen gains of nearly 9% during this period. Volatility in the iShares Silver Trust, the largest ETF tracking silver, reached its highest level since early 2021, when silver briefly captivated meme-stock traders. Nearly $1 billion has flowed into this ETF in the last week alone, surpassing the influx into the largest gold fund.

As Western investors, who have historically been under-allocated to precious metals, flock to silver ETFs, analysts believe there is substantial room for further inflows. Trevor Yates, a senior investment analyst at Global X ETFs, highlighted this trend, noting that as allocation normalizes, the potential for more investments in silver remains high. There has also been a significant uptick in options trading on Comex silver futures, as traders seek protection against price fluctuations and anticipate further rallies.

Retail interest is evident as well, with trading volumes on micro futures contracts reaching levels not seen since mid-October, according to CME Group Inc. An example of this enthusiasm can be seen in the recent activity involving over 5,000 lots of Comex silver February call spreads – equivalent to 25 million troy ounces – which changed hands in just two days. This reflects a growing appetite for profiting from anticipated price increases in the coming months.

The trajectory of silver prices remains uncertain. Meir stated, “When a chart breaks out like this, there are no resistance signposts.” Price predictions vary widely, with potential peaks suggested between $60 and $85.

Copper, while less influenced by financial speculation, is also expected to experience rising demand due to the need for electrification in AI data centers and clean-energy initiatives. Recently, copper prices reached an all-time high of more than $11,600 per ton on the London Metal Exchange. The volatility associated with March Comex contracts has also increased, with trading activity concentrated in call options above current market levels.

The dynamics of copper pricing have shifted following Donald Trump’s announcement in February regarding tariffs on the metal, aimed at boosting US supply. This move spiked New York futures above those on the LME, leading to a record increase in US imports, as major traders like Mercuria Energy Group Ltd. and Glencore Plc capitalized on the price differences.

Despite recent fluctuations, analysts like Xiaoyu Zhu from StoneX Financial Inc. emphasize that downside risks for copper prices are limited due to strong demand and supply constraints resulting from disruptions at major mines. The growing requirement for copper in electrification and the energy transition is a driving force behind these bullish fundamentals.

As global markets tighten, the effects of arbitrage trading have also contributed to the current supply constraints. Greg Sharenow, a portfolio manager at Pacific Investment Management Co., noted that the current situation could lead to price retracements of 10% to 15% in either silver or copper without impacting their long-term market narratives.

Investors will be closely monitoring these developments as the landscape for precious and industrial metals continues to evolve. With silver and copper emerging as the metals of choice, the market may see shifts that redefine investment strategies in the years to come.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169