Business

Explore New Avenues in Mining Beyond Gold Stocks

Gold prices have soared past the significant threshold of $4,000 per ounce, capturing the attention of investors worldwide. As excitement builds around this precious metal, two often-overlooked sectors within the mining industry present compelling opportunities for potentially higher returns: water rights and mining automation. While many focus on gold discoveries and established producers, these less visible areas may play a crucial role in reshaping mining economics for years to come.

Understanding the Value of Water in Mining

Water is a critical component in mining operations, yet it tends to be sidelined in favor of more prominent commodities like gold, copper, and lithium. Mines require vast amounts of water for various processes, including ore processing, dust suppression, and general operational needs. In regions such as the arid Pilbara in Australia and the high desert basins of Nevada, securing reliable access to water can be the decisive factor between a successful mining operation and a stranded asset.

Regulatory frameworks are evolving rapidly, with government agencies increasingly conducting thorough environmental impact assessments before approving extraction permits. Some areas have even enacted moratoriums on new groundwater drilling in sensitive aquifers, further complicating water access. As agriculture and urban development escalate competition for water resources, prices have surged, creating a bidding war for water entitlements. For mining companies that secured long-term water rights in advance, this situation translates into a significant competitive edge. Conversely, those lacking such rights now face heightened operational risks.

Investors can capitalize on this trend through various strategies. One direct approach involves specialized royalty companies and private funds that acquire water rights and lease them to industrial users, especially mining operations. These investments generate cash flows linked to inflation, offering a shield against metal price volatility. For instance, in the Truckee River Basin of Nevada, several funds have amassed over 50,000 acre-feet of water rights, purchased at pre-drought prices. As demand for water increases, these funds are poised to deliver double-digit annual yields.

Another strategy is to invest in agricultural land that comes with embedded water rights. In many Western states, water entitlements are associated with land ownership, making farmland an indirect play on water scarcity. Investors can acquire high-yield irrigation tracts and lease the water for premium prices to nearby mining operations, enhancing returns while retaining value in the land itself.

A third avenue involves technology and infrastructure firms. Companies like Xylem provide essential water treatment, desalination, and recycling solutions, all of which are increasingly vital as industries seek to diversify their water supply. These firms represent scalable investment opportunities in a sector facing mounting resource constraints.

The Role of Automation in Mining Productivity

In addition to water access, mining automation is emerging as another critical area for investment. The global market for mining automation is projected to exceed $8 billion by 2030, yet current adoption rates are surprisingly low, with fewer than 20% of major mines operating fully autonomous fleets. This gap between the potential for automation and its current state presents attractive investment opportunities.

Several challenges hinder the adoption of automation within the mining industry. Legacy equipment, remote locations, and resistance from traditional mining companies have slowed deployment, even as cost pressures mount. Initial capital requirements can be steep, with automation technologies consuming up to 15% of total capital expenditures for new mines, which can deter smaller operators. Unlike software companies that can scale quickly, the benefits of mining automation often take years to manifest, creating tension with quarterly earnings expectations.

Despite these barriers, the return on investment potential is noteworthy. Early adopters of automation technology are reporting significant improvements: 10% to 20% increases in throughput, 30% to 40% reductions in unscheduled downtime, and a substantial decrease in safety incidents. Payback periods for autonomous systems can be as short as two years, particularly when accounting for fuel optimization and operational efficiency.

Investment opportunities in this space span a variety of segments. Companies like Caterpillar and Komatsu lead the autonomous haulage market, providing systems that enhance efficiency at tier one operations in Australia and North America. Meanwhile, Sandvik AB is innovating in AI-powered ore sorting, which significantly reduces energy consumption per ton of concentrate recovered.

Remote operations are also gaining traction, as firms like Epiroc AB and ABB Ltd develop centralized control hubs. These hubs allow a single operator to manage multiple mine sites, improving disaster response capabilities and reducing on-site staffing needs. Smaller, specialized automation providers like Hexagon AB are also well-positioned for growth, focusing on software and hardware solutions that enhance mining operations.

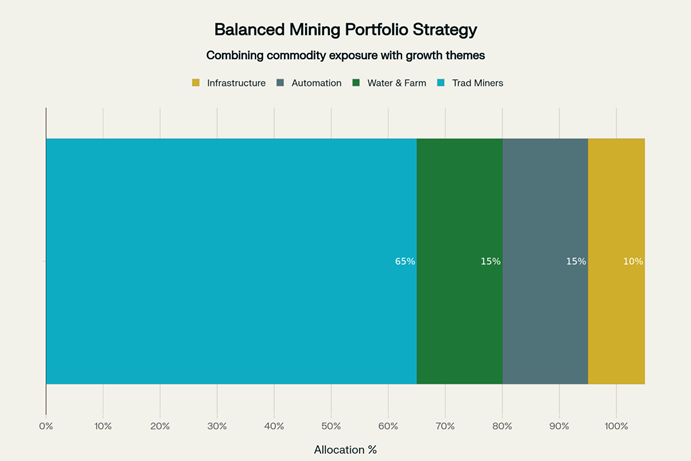

Investors seeking to build a balanced portfolio might consider allocating 60% to traditional mining equities, which include established producers of gold, silver, and copper. The remaining 40% could be divided among water rights (15%), automation and digital services (15%), and specialist infrastructure such as desalination or remote operations software (10%). This diversified structure can help mitigate the cyclicality of commodity prices while tapping into enduring trends of resource scarcity and productivity enhancement.

As gold’s price continues to garner attention, the underlying themes of water rights and automation are poised to significantly impact the mining landscape. These sectors offer strategic advantages that could define which companies thrive and which falter in the evolving market. By recognizing the importance of these often-overlooked areas, investors can position themselves for the next wave of growth in the mining industry.

-

Education4 months ago

Education4 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science5 months ago

Science5 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle5 months ago

Lifestyle5 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Science5 months ago

Science5 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Health5 months ago

Health5 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Technology5 months ago

Technology5 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Education5 months ago

Education5 months agoRed River College Launches New Programs to Address Industry Needs

-

Business4 months ago

Business4 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology5 months ago

Technology5 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Top Stories4 weeks ago

Top Stories4 weeks agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Technology3 months ago

Technology3 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education5 months ago

Education5 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Business1 month ago

Business1 month agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Business5 months ago

Business5 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science5 months ago

Science5 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle3 months ago

Lifestyle3 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business5 months ago

Business5 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Business5 months ago

Business5 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology5 months ago

Technology5 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Top Stories4 months ago

Top Stories4 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Top Stories3 months ago

Top Stories3 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Technology5 months ago

Technology5 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge