Business

Tether Expands Lending Operations to Commodities Sector with $1.5 Billion Initiative

Tether Holdings SA, a leading player in the stablecoin market, has announced plans for a significant expansion into commodities trade lending. Chief Executive Officer Paolo Ardoino revealed that the El Salvador-based company has already extended approximately $1.5 billion in credit to the commodities sector, which includes key markets such as oil, cotton, and wheat.

In a recent interview, Ardoino stated that Tether aims to ramp up financing efforts, leveraging both US dollars and its widely used USDT stablecoin, which is pegged to the US dollar. This initiative marks a strategic move for Tether as it seeks to increase its footprint in the commodities market.

Tether’s expansion comes at a time when traditional banks have tightened their lending practices in the commodities sector. While the company remains a relatively minor player compared to larger banks, its substantial reserves—almost $200 billion—provide a strong foundation for competitive lending. Ardoino noted the growing acceptance of USDT in commodity-exporting regions, particularly in Latin America, as a promising avenue for growth.

Meeting the Demand for Commodity Financing

Credit is essential in the commodities industry, where vast sums are required to facilitate the movement of essential goods such as food, metals, and energy. The majority of loans in this sector are denominated in US dollars, presenting a potential barrier for businesses that may hesitate to borrow in USDT. Nonetheless, Tether’s entry into commodities finance aligns with the increasing demand for private credit solutions, especially for smaller trading firms facing challenges in accessing traditional banking resources.

The landscape of commodities finance has evolved after several years of setbacks in the banking sector, including high-profile failures and allegations of fraud. Major trading companies like Trafigura and Cargill maintain access to extensive lending resources, but smaller firms often struggle, resulting in a burgeoning market for private lenders. These lenders, including Tether, typically charge higher interest rates to account for the increased risks associated with lending in more volatile regions.

Ardoino expressed optimism about Tether’s commodities lending venture, stating, “We are going to expand dramatically. The team is super bullish.” He emphasized the advantages of commodities finance, noting that credit lines are frequently utilized and repaid within short timeframes, such as the less-than-a-month duration for transporting shipments of wheat or oil.

Broader Business Ventures and Market Position

Tether’s ambitions extend beyond lending, as the company is also making strides in various markets, including artificial intelligence and sports. This diversification coincides with the rapid growth of the stablecoin market, driven in part by favorable legislation in the United States. Following the passage of stablecoin regulations in July, the adoption of digital tokens for transfers and payments has surged globally.

With almost $184 billion in circulation, USDT stands at the forefront of the stablecoin sector. Tether’s requirement to back each coin with liquid assets, such as US Treasury Bills, helps generate substantial interest revenue, with projections indicating a potential profit of around $15 billion for 2025.

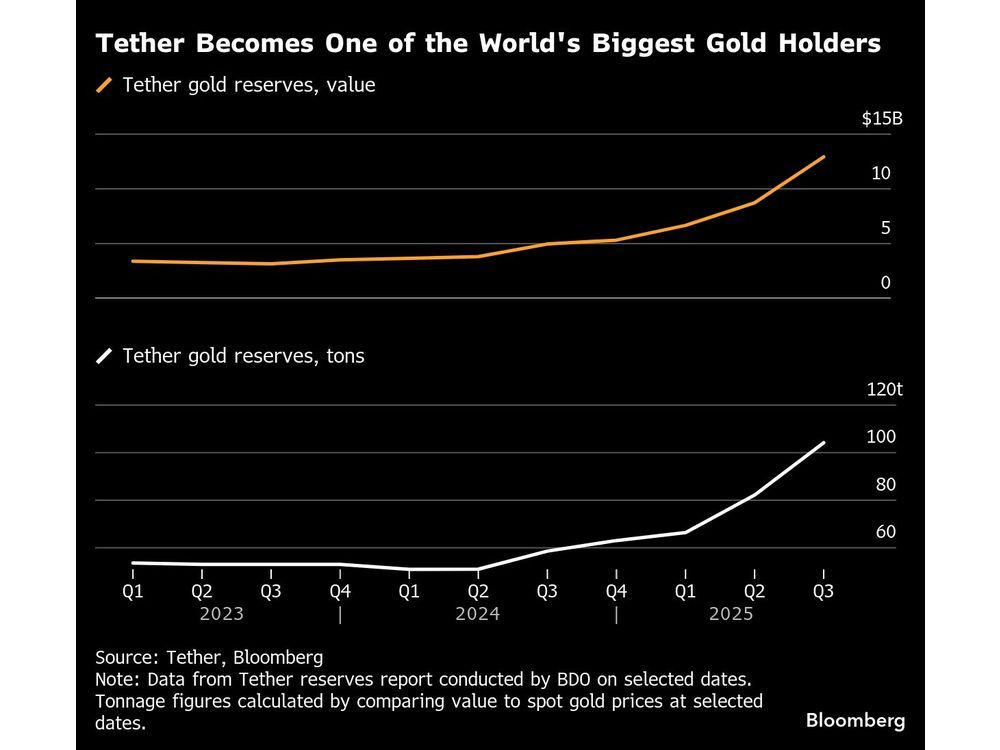

Despite the lack of audited financial results, Tether is also building its commodities operations in precious metals. The company is reportedly acquiring two senior precious metals traders from HSBC Holdings Plc to further strengthen its position in this domain. Tether’s gold-backed stablecoin currently holds a market value of nearly $2.2 billion, according to CoinGecko.

In addition, Tether is increasing its investment in South American agricultural and energy production by raising its stake in Adecoagro SA to 70%. This strategic move aims to bolster its involvement in the commodities sector, as demonstrated by the recent appointment of commodity trading expert Kyril Louis-Dreyfus to Adecoagro’s board.

As Tether continues to navigate the evolving landscape of finance and commodities, its ambitious expansion plans could reshape its role within the industry and potentially enhance access to capital for traders worldwide.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169