Top Stories

Poland’s Central Bank Poised for Sixth Rate Cut Amid Low Inflation

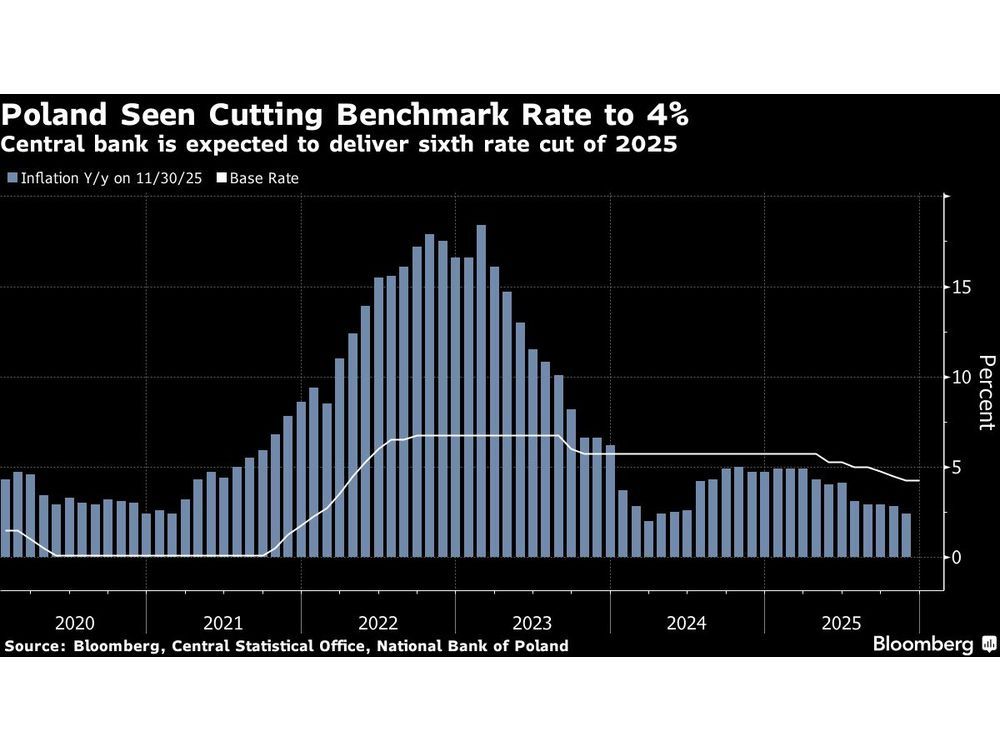

Poland’s central bank is preparing for its sixth interest-rate cut of the year, responding to a significant slowdown in inflation. The key interest rate is expected to decrease by 25 basis points to 4%. This would mark the lowest rate since March 2022, as inflation fell to 2.4% in November, down from 4.9% at the beginning of the year. The decision comes as a result of the latest data, which indicated inflation has dipped below policymakers’ target.

According to a survey conducted by Bloomberg, 27 out of 32 economists anticipate this rate reduction. The remaining analysts believe borrowing costs will remain stable. If the predicted cut occurs, it will be the fifth consecutive reduction, reflecting the Monetary Policy Council’s (MPC) efforts to adjust to softer inflation rates.

Economic Impact and Future Outlook

Central bank Governor Adam Glapinski has not dismissed the possibility of further easing, despite not providing a specific timeline for additional cuts. Glapinski, who often influences the direction of the MPC, has indicated that a rate of 4% is reasonable if inflation continues to stabilize. MPC members, including Wieslaw Janczyk and Ireneusz Dabrowski, have also hinted that further reductions in December may be on the table if inflation trends remain favorable.

Economist Juan Orts from Societe Generale SA expressed that the likelihood of the terminal rate remaining at 4% seems unrealistic, given the current inflation forecast. He anticipates that the MPC will confront increasing pressure to lower rates as the inflation outlook remains consistently optimistic through 2026. Orts predicts inflation will stay below the MPC’s target of 2.5% next year, expecting the benchmark rate to drop to 3.5% in the second quarter of 2024, with potential for further adjustments later in the year.

The MPC’s greater willingness to cut rates, including an unexpected reduction in October, has led analysts to revise their expectations. Orts noted, “Actions count more than words, and after the surprise cut in October, it became clear to us that the MPC had a lot more appetite for rate cuts than what we had initially believed.”

Glapinski has previously supported maintaining higher rates through 2024, attributing this stance to the government’s fiscal policies and uncertainties surrounding energy price caps. Recently, however, he has softened his critical rhetoric towards the government. A press conference is scheduled for 15:00 on Thursday, where further insights may be provided regarding the central bank’s future strategies.

As Poland navigates these economic changes, the implications for consumers and businesses could be significant, particularly in sectors sensitive to borrowing costs. The upcoming rate cut may provide relief to borrowers and stimulate economic activity, aligning with the MPC’s broader objectives to foster a stable economic environment.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169