Science

U.S. Military Tech Market Projected to Reach USD 10.4 Billion by 2032

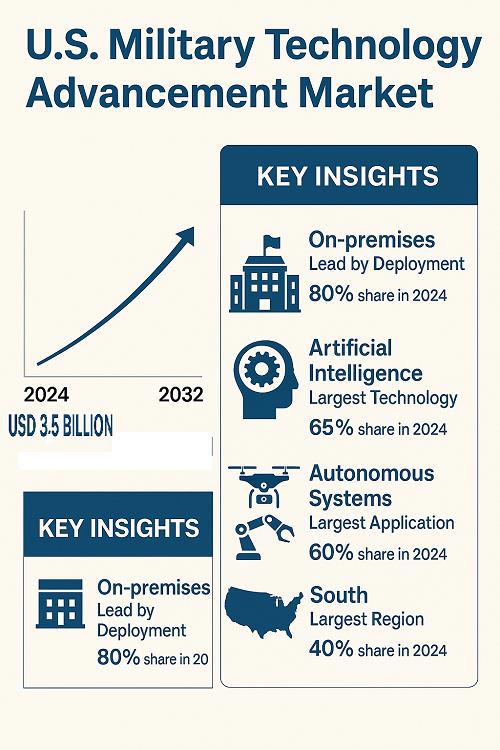

The U.S. military technology market is on a trajectory for significant growth, projected to reach a value of USD 10.4 billion by 2032, up from USD 3.5 billion in 2024. This information comes from a recent study conducted by P&S Intelligence, which forecasts a compound annual growth rate (CAGR) of 14.8% between 2025 and 2032. The anticipated expansion is primarily driven by increased defense budgets, the adoption of innovative technologies, and escalating geopolitical tensions that necessitate enhanced military capabilities.

Investment Trends and Strategic Initiatives

A key factor in this growth is the strategic focus of the U.S. Department of Defense (DoD), which is ramping up investments in next-generation defense systems, including hypersonic weapons, quantum communication, and robotic combat solutions. The government’s commitment to fostering public-private partnerships is also crucial, as it enhances innovation within military infrastructure. In addition, the emphasis on supply chain resilience and battlefield readiness is vital for supporting advanced, scalable solutions that facilitate joint mission success.

Notably, the on-premises deployment category accounted for 80% of the market share in 2024. This is due to the reliability of localized IT infrastructure, which is essential for command centers and field operations. These systems are designed to ensure continuous operability in environments with limited connectivity, making them ideal for high-security military operations.

Conversely, cloud-based deployment is expected to see the fastest growth through 2032. This growth is supported by the DoD’s collaborations with leading cloud service providers, including AWS, Microsoft Azure, and Google Cloud. Such integrations facilitate seamless data sharing, real-time intelligence processing, and improved decision-making across military branches.

Technological Innovations and Market Dynamics

In terms of technology adoption, artificial intelligence (AI) led the market in 2024, holding a 65% share. The widespread implementation of AI in autonomous systems, predictive analytics, and battlefield intelligence has significantly enhanced capabilities such as real-time threat detection and strategic decision-making, while also minimizing human risk.

The domain of cyber warfare is projected to experience the highest CAGR, driven by an increase in state-sponsored cyberattacks and digital espionage. This growth highlights the rising demand for secure communications, encrypted networks, and AI-driven cyber defense mechanisms.

Autonomous systems represent the largest and fastest-growing segment of the market, with a share of 60% in 2024. Their deployment across unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and robotic systems significantly increases battlefield efficiency while reducing human exposure to danger. Initiatives like Project Maven by the DoD are significant contributors to this trend.

Geographically, the South of the United States led the market with a 40% share in 2024. This dominance is attributed to the concentration of military bases, defense contractors, and government research centers located in states like Virginia, Texas, and Florida, which host major companies such as Lockheed Martin and Northrop Grumman. Meanwhile, the West is anticipated to experience the fastest growth, spurred by innovations in space-based defense, AI, and cybersecurity, with companies like SpaceX and Raytheon Technologies at the forefront.

The market landscape is characterized by consolidation, with leading players such as Boeing and RTX securing multi-billion-dollar defense contracts. These companies maintain strategic partnerships with the DoD, positioning themselves at the heart of U.S. military innovation.

Recent developments underscore this momentum, including the launch of military satellites in August 2024 aimed at enhancing communication capabilities in the Arctic. Additionally, Blue Origin secured a five-year FAA license in December 2024 to conduct orbital launches from Cape Canaveral, marking a significant step forward in military space operations.

As the U.S. military technology market continues to evolve, the focus on advanced, integrated solutions will remain pivotal in addressing the complexities of modern warfare and defense strategies.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169