Business

Investor Sentiment Shifts as AAII Index Indicates Bearish Trends

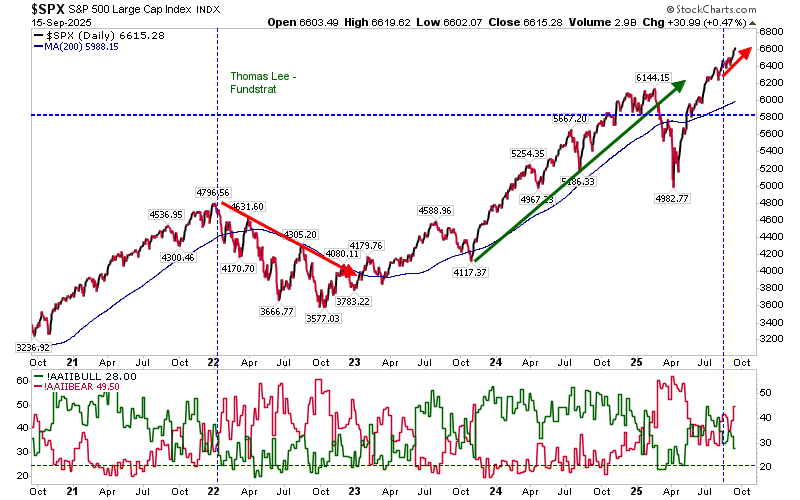

Investor sentiment is showing signs of increasing bearishness, according to the latest data from the American Association of Individual Investors (AAII). This trend mirrors the investor mood at the beginning of 2022, when a significant market sell-off affected confidence. While the current stock market momentum remains robust, concerns are rising about whether this positive trend can sustain itself.

On Monday, stock indices experienced minimal fluctuations, prompting analysts to delve deeper into market dynamics. The AAII Bullish/Bearish Sentiment Index indicates a growing caution among investors. Earlier this year, a tariff-related sell-off severely impacted sentiment, but a subsequent rally has kept many investors engaged. In contrast to 2022, when the S&P 500 continued to decline throughout the year, this year’s market has shown resilience.

Analysts are particularly focused on the Semiconductor Index, which experienced a breakout last week and further subtle gains on Monday. This movement suggests a favorable outlook for the sector, as technical analysis indicates potential for additional advances. The index appears well-positioned for continued growth, offering optimism to investors.

In the cryptocurrency arena, Bitcoin ($BTCUSD) also had a modest accumulation day, marking its third such day following a period of distribution. This accumulation has prompted a new ‘buy’ signal in the On-Balance Volume indicator, although stochastics remain below 50, indicating that overall technical signals have not yet turned positive.

The Nasdaq Summation Index ($NASI) is providing an opportunity for a pullback ‘buy’ signal, having recently eased from an overbought condition. This development could benefit not only the Nasdaq but also Bitcoin and the Semiconductor Index as they navigate through current market conditions.

For now, the consensus among analysts is a cautious “hold” for major indices, with expectations that the upward trajectory seen thus far is likely to continue. Despite the complexities of the prevailing political environment, market trends often operate independently of external factors, leaving investors to carefully monitor developments in the coming weeks.

As the market evolves, the implications of shifting investor sentiment will be crucial for understanding future movements. The interplay between bullish trends and bearish signals will shape investment strategies moving forward.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169