Business

ECB Maintains Interest Rates Amid France’s Political Turmoil

The European Central Bank (ECB) is expected to maintain its current interest rates during a meeting scheduled for next week, despite the escalating political crisis in France. As officials gather in Frankfurt, the situation in France remains precarious, with the potential collapse of Prime Minister Francois Bayrou‘s government anticipated. This upheaval complicates the fiscal landscape of the eurozone’s second-largest economy, leaving uncertainty in its wake.

Market attention is sharply focused on the ECB’s President Christine Lagarde, who has previously held the position of finance minister in France. Investors are keen to dissect Lagarde’s comments during the meeting, looking for insights regarding her stance on addressing the political unrest that could affect the broader eurozone economic stability.

The political landscape in France has intensified, especially after Bayrou called for a confidence vote among lawmakers that he appears increasingly likely to lose. Should his government fall, the focus will shift to President Emmanuel Macron, who will need to devise a plan to restore political stability. This ongoing drama may overshadow discussions at the ECB regarding inflation and the economic outlook for the region.

In addition to the political developments, the ECB will release its quarterly forecasts for inflation, the first since the European Union established a trade deal with the United States that imposed tariffs of 15% on European goods. Officials have indicated a cautious approach to future borrowing cost decisions, with Lagarde set to acknowledge the lack of clarity on the direction of eurozone interest rates.

According to Bloomberg Economics, the ECB is reluctant to lower rates in the immediate future. Senior economist David Powell noted, “Policymakers are waiting for clearer signals on how the economy is responding to trade headwinds, and underlying inflation has yet to fall as much as they would like.”

The political instability in France may further complicate the ECB’s economic forecasts, particularly if it dampens growth prospects for the region. A scheduled assessment from Fitch Ratings on Friday could add another layer of complexity if it results in a downgrade of France’s credit outlook, which is currently negative.

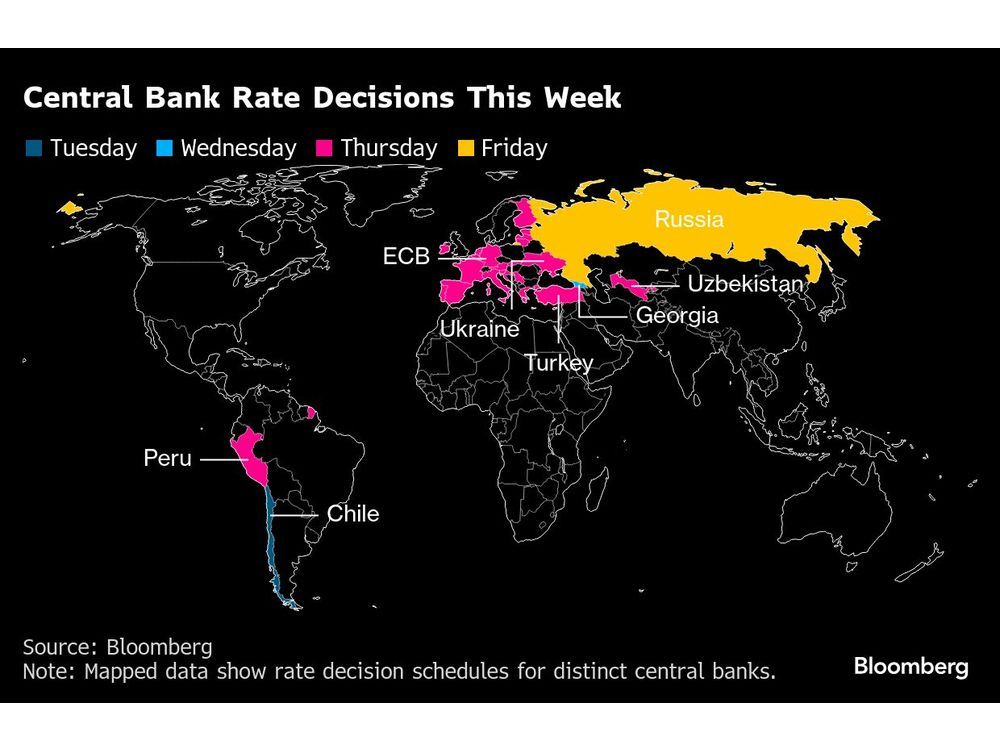

In the broader economic context, attention will also be on consumer prices in the United States, a range of economic data from China, and potential interest rate adjustments in Turkey. These developments form part of a busy economic calendar that will influence market expectations and investor confidence ahead of the ECB’s decision on September 16-17.

As the situation unfolds, the implications of France’s political turmoil on the eurozone’s economic health remain a critical area for observers and policymakers alike. The interconnectedness of these issues underscores the importance of monitoring both domestic and international factors that impact economic stability across Europe.

-

Education4 months ago

Education4 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science5 months ago

Science5 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle5 months ago

Lifestyle5 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Science5 months ago

Science5 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Health5 months ago

Health5 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Technology5 months ago

Technology5 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Education5 months ago

Education5 months agoRed River College Launches New Programs to Address Industry Needs

-

Business4 months ago

Business4 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology5 months ago

Technology5 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Top Stories4 weeks ago

Top Stories4 weeks agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Technology3 months ago

Technology3 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education5 months ago

Education5 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Business1 month ago

Business1 month agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Business5 months ago

Business5 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science5 months ago

Science5 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle3 months ago

Lifestyle3 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business5 months ago

Business5 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Business5 months ago

Business5 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology5 months ago

Technology5 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Top Stories4 months ago

Top Stories4 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Top Stories3 months ago

Top Stories3 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Technology5 months ago

Technology5 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge