Business

UK Chancellor Rachel Reeves Receives Unexpected Boost from Inflation

Chancellor of the Exchequer Rachel Reeves is poised to gain an unexpected financial advantage as the UK grapples with persistent inflation. With just under two months remaining to address a multi-billion-pound budget deficit, analysis indicates that rising prices may enhance government tax revenues, possibly providing a net boost of £5 billion (approximately $6.7 billion) to her fiscal plans.

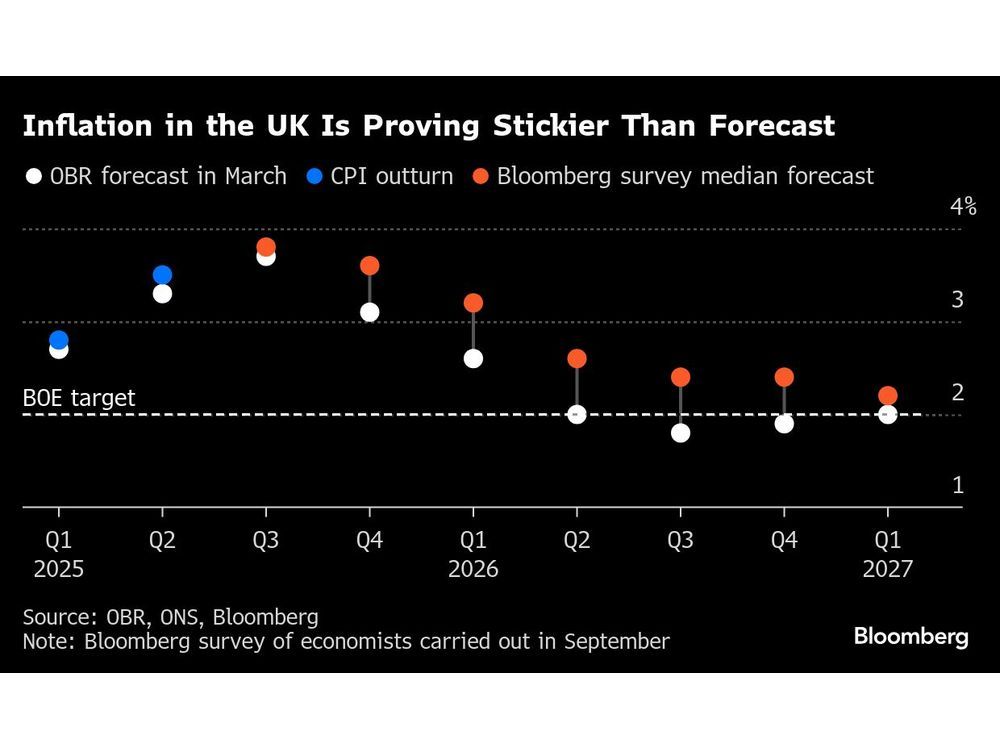

According to experts, including former Bank of England rate-setter Michael Saunders, the Office for Budget Responsibility (OBR) is likely to revise its projections for price and wage growth in the upcoming years. This revision is expected to align more closely with forecasts from the Bank of England and private-sector analysts. This development could alleviate some of the financial pressure on Reeves as she prepares for the next budget announcement scheduled for November 26, 2023.

The OBR’s updated forecasts will be critical, especially as Reeves faces an anticipated shortfall between £20 billion and £30 billion. While inflation presents challenges for everyday consumers, the increase in taxable income and profits can translate into heightened tax receipts for the government.

Despite the potential benefits, inflation poses a double-edged sword for the Treasury. Higher prices are expected to influence the central bank’s approach to interest rates, likely slowing the pace of cuts. This situation could keep the cost of servicing government debt high, currently accounting for nearly one-tenth of all government expenditure.

Saunders, now a senior adviser at Oxford Economics, noted that the tax revenue gains from increased wages and prices—estimated at £9 billion—will surpass the expected rise in debt servicing costs, projected at £4 billion. “The public finances are net beneficiaries of higher inflation, assuming public spending is fixed,” he stated.

The surge in inflation has been fueled by rising energy and food prices, causing the rate of price growth to nearly double the Bank of England’s target of 4%. Wage growth, while cooling, remains elevated at just below 5% for salaries excluding bonuses. As a result, the government’s spending plans may become less generous than initially intended. Reeves will have to navigate these dynamics carefully, potentially opting not to increase expenditures to offset the declining value of money.

Economists are predicting that Reeves will need to implement significant tax increases in her budget to maintain compliance with her fiscal rule, which mandates balancing day-to-day spending with tax receipts by the fiscal year ending in 2029-2030. The economic landscape has shifted since the last fiscal statement in March, with elevated borrowing costs, downgraded growth projections, and a reevaluation of welfare spending all contributing to a challenging financial outlook.

In March, the OBR’s forecasts were relatively conservative, predicting pay growth at 2.3% and consumer price index inflation at 2.1% for 2026. Recent trends suggest that these figures are well below current external forecasts from institutions such as the International Monetary Fund, Organisation for Economic Co-operation and Development, and the Bank of England.

As Rachel Reeves prepares her budget strategy, the interplay between inflation, tax revenue, and public spending will be crucial in determining how effectively she can address the UK’s financial challenges.

-

Education5 months ago

Education5 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science6 months ago

Science6 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle5 months ago

Lifestyle5 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health6 months ago

Health6 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science6 months ago

Science6 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology6 months ago

Technology6 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Business2 months ago

Business2 months agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Technology3 weeks ago

Technology3 weeks agoDigg Relaunches as Founders Kevin Rose and Alexis Ohanian Join Forces

-

Top Stories2 months ago

Top Stories2 months agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Education6 months ago

Education6 months agoRed River College Launches New Programs to Address Industry Needs

-

Business5 months ago

Business5 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology6 months ago

Technology6 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Education6 months ago

Education6 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology4 months ago

Technology4 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Business6 months ago

Business6 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science6 months ago

Science6 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle4 months ago

Lifestyle4 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business6 months ago

Business6 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business1 month ago

Business1 month agoNvidia and AMD CEOs Unveil AI Innovations at CES 2026

-

Business4 months ago

Business4 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Business6 months ago

Business6 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Top Stories4 months ago

Top Stories4 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Technology6 months ago

Technology6 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase