Top Stories

UK Households Hoard Cash, Sparking Concerns for Christmas Spending

UK households are increasingly hoarding cash rather than spending it, as a sense of financial insecurity looms. According to a recent analysis by Michael Saunders, a senior advisor at Oxford Economics, the trend reflects the lasting impact of economic shocks over the past five years. With the festive season approaching, this growing reluctance to spend raises concerns for retailers and suppliers.

In his paper, Saunders highlighted that Britons are saving a larger portion of their income due to fears they do not have enough set aside for emergencies. The environment of higher interest rates, which makes saving more attractive, further contributes to this behavior. Official figures released on October 2023 indicated that the UK economy contracted for a second consecutive month, heightening worries about the potential for its first quarterly downturn in two years.

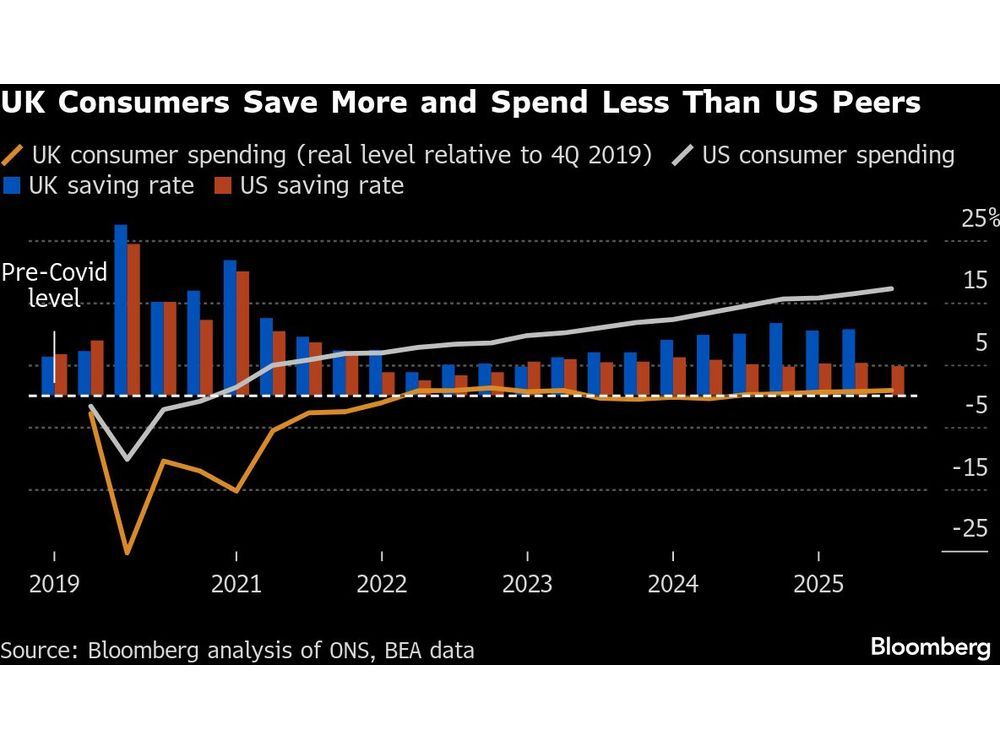

Consumer spending is critical for economic growth, accounting for approximately 60% of national output. However, it has stagnated for the past three years, posing a significant drag on the economy. This stands in stark contrast to the United States, where consumer expenditure has fueled robust economic growth among the Group of Seven nations. A revival in household spending is essential for maintaining the tax revenues that Chancellor of the Exchequer Rachel Reeves requires to execute her budget plans.

Saunders noted that households have been deeply affected by the pandemic and the subsequent cost-of-living crisis, which saw inflation peak at over 11% in late 2022, coupled with rising mortgage rates. While the average household possesses more savings than prior to the pandemic, many continue to set aside a historically high proportion of their disposable income.

“Even though the median level of liquid assets is higher now than the pre-pandemic period, the share of households who say they don’t have enough savings for emergencies has risen markedly,” Saunders stated. He pointed out that current saving rates are about 2.5 percentage points higher than the long-term average, particularly among individuals aged 25 to 55, renters, and those with minimal savings.

The Bank of England anticipates only a modest decrease in the current saving rate of over 10% in the coming years. Governor Andrew Bailey recently acknowledged consumers’ “high level of caution” amid ongoing uncertainty. Market projections suggest a quarter-point cut in interest rates on December 18, bringing them down to 3.75%, with expectations of further adjustments thereafter.

Saunders utilized “micro data” from the Bank of England’s annual NMG survey of around 6,000 households, conducted since 2010, to analyze the reasons behind the UK’s cautious consumption habits. Interestingly, pensioners have not been as adversely affected by recent economic challenges. “Financial insecurity has fallen among the over 65s, probably because the triple lock has protected pension income and with higher levels of assets they have benefited from higher interest rates,” he explained.

Historical patterns indicate that significant economic shocks often lead to increased precautionary saving. Saunders referenced past episodes of extreme volatility, such as the Great Depression in the 1930s and the inflation surge in the 1970s in the UK, which created similar behavioral changes among consumers.

A separate survey conducted by consulting firm RSM involving 2,000 consumers revealed that if presented with a one-off windfall of £5,000 ($6,673.5), nearly 57% would choose to save it or pay down debt, while only 8% indicated they would use it for Christmas presents.

As the holiday season approaches, the combination of increased savings and consumer hesitance poses significant challenges for retailers, who rely on this crucial trading period for their financial health. The overall sentiment suggests that without a shift in consumer confidence, the festive season may not deliver the economic boost many hope for.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education4 months ago

Education4 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169