Top Stories

Clean Energy Stocks Surpass Major Indices Amid AI Demand Surge

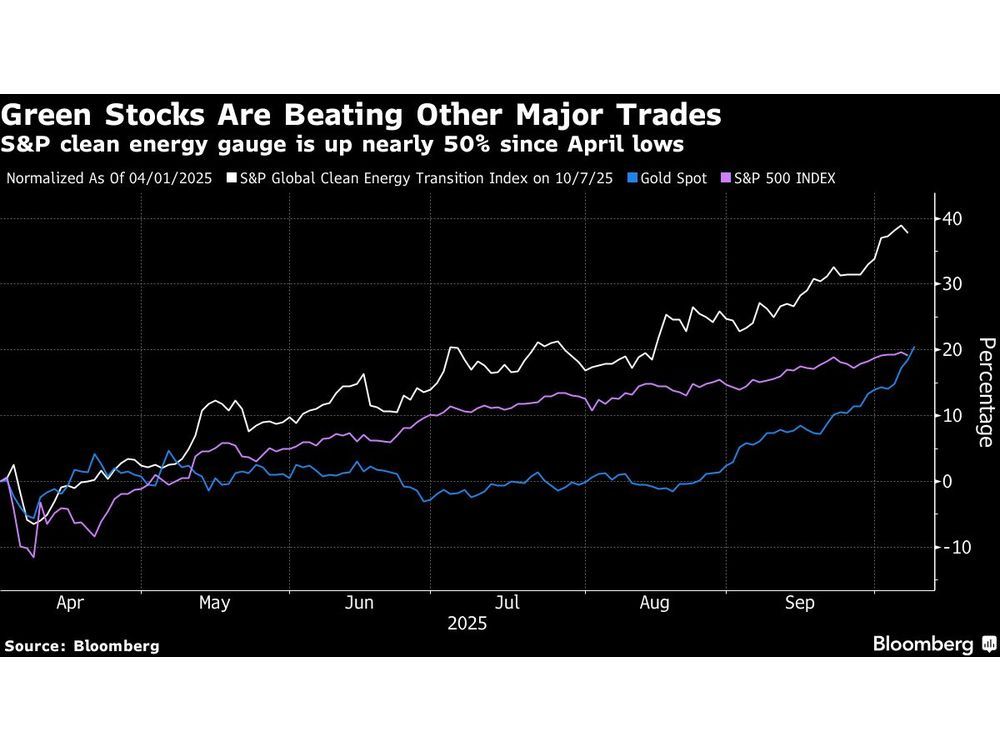

The global market for clean energy stocks is experiencing a remarkable upswing, outperforming major equity indices and even gold. The S&P Global Clean Energy Transition Index has surged by nearly 50% since April 2023, following tariff announcements by former US President Donald Trump that rattled financial markets. In contrast, both the S&P 500 Index and gold have recorded gains of approximately 35% during the same timeframe.

Investor optimism surrounding green stocks has been fueled by the increasing energy demands associated with the rise of artificial intelligence. As the shift towards AI accelerates, the reliance on renewable energy sources becomes critical. Despite efforts to weaken green policies by the Trump administration, countries including China, India, Europe, and several states within the United States remain steadfast in their commitment to low-carbon initiatives.

Market Trends and Performance

Lower interest rates in the US have further bolstered the green energy sector, which is typically capital-intensive and reliant on debt financing. In China and Hong Kong, shares in the clean energy sector are rebounding as the government addresses overcapacity in solar components such as polysilicon and wafers. The S&P clean energy index outperformed the S&P Global Oil Index since early April and is currently outperforming all major country equity indices worldwide, except for South Korea.

According to Shaheen Contractor, a senior ESG analyst at Bloomberg Intelligence, clean energy indexes often show little correlation with the broader market, making them attractive for tactical investments when catalysts arise. She notes that energy demand driven by AI could potentially more than double by 2028, favouring technologies such as solar, energy storage, and gas capabilities.

Leading companies within the clean energy sector are experiencing significant gains. Bloom Energy Corp., known for its fuel cell technology, and Goldwind Science & Technology Co., the world’s largest wind turbine manufacturer, have both seen their share prices increase by triple-digit percentages this year.

Despite this impressive rebound, the S&P clean energy index still sits at only half of its peak level from 2021, when interest rates were exceptionally low and green investments flourished due to the pandemic’s economic impact.

Future Outlook

Aniket Shah, managing director and global head of sustainability and transition strategy at Jefferies Financial Group Inc., characterizes the current phase of green investments as the arrival of a new era. He states, “We are in this wonderful moment where both the capital markets and the real economy are actually accelerating their efforts around sustainability and the energy transition.”

As demand for clean energy continues to escalate, the market may witness further growth and innovation, solidifying the role of renewable resources in the future energy landscape.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education4 months ago

Education4 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169