Top Stories

Chinese Battery Makers Surge Amid Solid-State Technology Hopes

Chinese battery manufacturers are experiencing a surge in stock prices, fueled by optimism surrounding the commercialization of solid-state battery technology. This innovation, which replaces some liquid components with solids, is seen as pivotal for the future of electric vehicle (EV) batteries. As interest grows, investors are increasingly optimistic about the timeline for bringing these advanced batteries to market.

One notable beneficiary of this trend is Contemporary Amperex Technology Co. Ltd., the world’s largest EV battery producer. Its shares, which are listed in Hong Kong, are on track for their highest closing price since their initial public offering in May. Analysts from JPMorgan & Chase Co. attribute this rise to a broader “thematic trade” on solid-state optimism, driven by positive forecasts from equipment manufacturers and a rise in energy-storage investments within China.

In addition to Contemporary Amperex, other companies are also making significant strides. Wuxi Lead Intelligent Equipment Co. has seen its stock climb approximately 25% following its announcement of a “complete” production process for solid-state technology. Meanwhile, Gotion High-Tech Co. plans to begin “semi-solid” mass production next year, according to analysts from Citigroup Inc., who cited recent earnings presentations. Furthermore, EVE Energy Co. opened a solid-state research facility in Chengdu earlier this month, offering further clarity on the potential timeline for this long-anticipated technology.

Max Reid, head of battery technology and costs at consultancy CRU Group, expressed increased confidence in the commercialization of solid-state batteries. He noted, “What’s changed is Chinese companies committing to production lines,” predicting that mass production could commence in the late 2020s. Solid-state batteries are expected to deliver higher energy density and enhanced safety compared to traditional lithium-ion batteries, although their development has been hampered by cost and technical challenges.

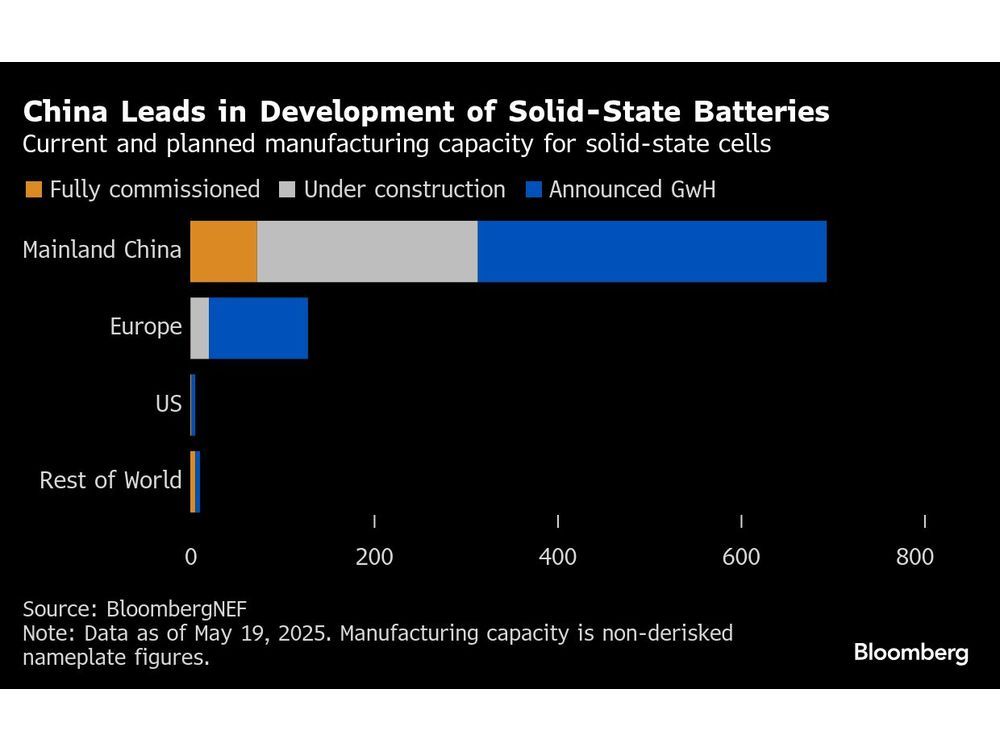

According to data tracked by BloombergNEF, less than 10% of global solid-state capacity is currently operational, with most production coming from Chinese manufacturers focused on semi-solid battery technologies. These batteries are commonly used in sectors that require high energy density, such as medical devices and small aircraft, where cost sensitivity is lower.

In contrast to China’s advancements, South Korea’s SK On Co. aims for mass production of solid-state batteries by 2029, while QuantumScape Corp. in the United States reported a 20% increase in its shares after showcasing a solid-state cell at a major auto show in Munich last week.

Despite these promising developments, many projects are struggling to adhere to timelines set earlier this decade. Transitioning from pilot plants to full-scale production demands new facilities for raw material processing, electrode fabrication, and cell assembly. Notably, solid-state battery plants in China require around 8% more capital expenditure than traditional lithium-ion facilities, and the supply chains for this emerging technology remain underdeveloped, as highlighted by BloombergNEF’s recent analysis.

As excitement builds around solid-state battery technology, it is essential to remain cautious. Recent fluctuations in battery stocks underscore the sensitivity of investors to technological advancements and market developments. The road to widespread adoption of solid-state batteries may still have hurdles to overcome, but the momentum within the industry suggests a promising future for electric vehicles and energy storage solutions.

-

Education2 months ago

Education2 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Science3 months ago

Science3 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Health3 months ago

Health3 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science3 months ago

Science3 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology3 months ago

Technology3 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Technology1 month ago

Technology1 month agoDiscord Faces Serious Security Breach Affecting Millions

-

Business2 months ago

Business2 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology3 months ago

Technology3 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business3 months ago

Business3 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology1 month ago

Technology1 month agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology3 months ago

Technology3 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology3 months ago

Technology3 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology3 months ago

Technology3 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science3 months ago

Science3 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology3 months ago

Technology3 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169

-

Technology3 months ago

Technology3 months agoDiscover the Relaxing Charm of Tiny Bookshop: A Cozy Gaming Escape