Technology

Profit Recovery in France and Germany Faces Challenges Ahead

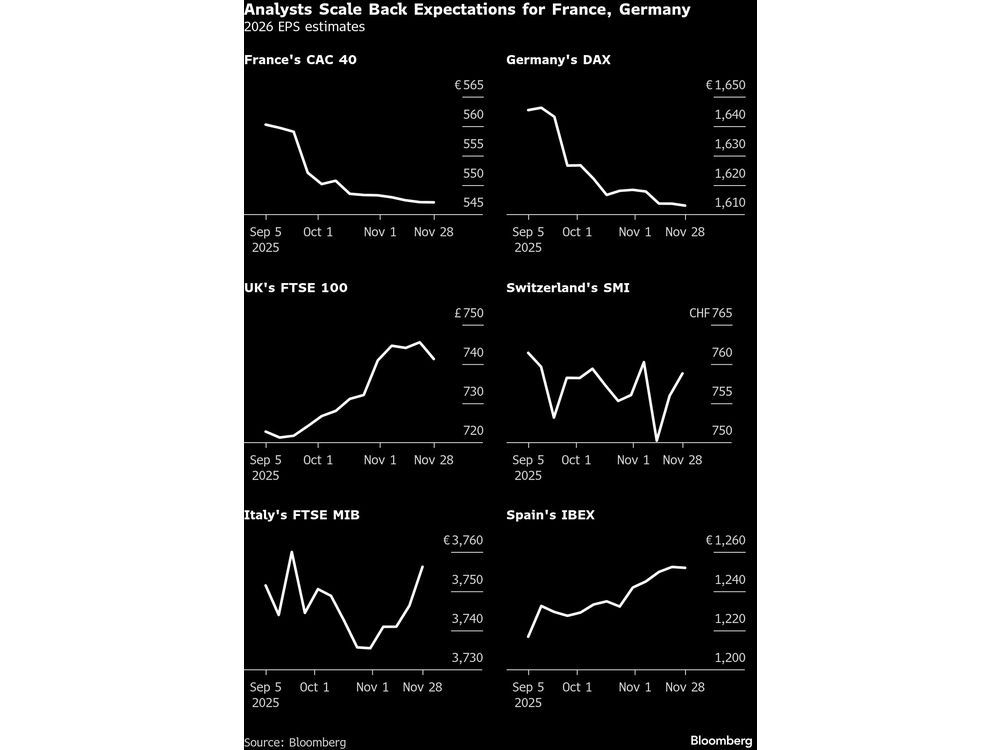

Profit expectations for France and Germany are under pressure as the luxury and automotive sectors encounter significant challenges. Recent data from Bloomberg Intelligence indicates a downward revision of earnings forecasts for France’s CAC 40 and Germany’s DAX indexes for the upcoming year. In contrast, estimates for other European benchmarks are being adjusted upwards, highlighting a divergence in market performance.

The CAC 40 and DAX indexes are heavily weighted towards consumer discretionary and industrial sectors. This reliance raises concerns, particularly as both sectors may struggle to meet elevated expectations in 2024. The DAX, for instance, is largely comprised of major automotive manufacturers such as BMW AG, Volkswagen AG, and Mercedes-Benz Group AG, all of which have faced multifaceted challenges this year.

Luxury Sector Recovery Uncertain

In France, leading luxury brands like LVMH Moët Hennessy Louis Vuitton SE, Hermès International SCA, and Kering SA are tasked with demonstrating that demand recovery, particularly in the United States and China, is not only ongoing but also strengthening. Kering is especially under scrutiny, as its shares have surged by 23% this year, fueled by optimism surrounding new Chief Executive Officer Luca de Meo. Analyst Adam Cochrane from Deutsche Bank cautions that while investor sentiment is currently positive, there is a risk that expectations for the company’s performance could become overly ambitious. He predicts potential earnings downgrades when Kering reveals its strategic plans in early 2024.

Automotive Sector Faces Structural Challenges

Germany’s automotive sector is grappling with various pressures, including US tariffs and a slowdown in demand from China. The competitive landscape has intensified with increasing pressure from Chinese car manufacturers, further complicating recovery efforts. According to analysts Kaidi Meng and Laurent Douillet from Bloomberg Intelligence, the DAX’s ability to rebound is significantly tied to the automotive industry, which continues to face structural issues despite any cyclical improvement in demand.

Analyst Harald Hendrikse from Citigroup warns of persistent declines in market share and profitability for European carmakers in China, which are expected to persist through 2026. The exposure of BMW and Mercedes to the Chinese market places them at heightened risk of marked earnings declines.

On the industrial front, the outlook for German manufacturers depends heavily on substantial infrastructure investments and increased defense spending within the European Union. While a softer euro and geopolitical stability could provide support, these advantages are not guaranteed. Industrial firms like Daimler Truck Holding AG are particularly vulnerable, facing a 25% tariff on medium- and heavy-duty trucks sold in the US, which could potentially reduce their profits by up to 30%.

French industrial companies, including Schneider Electric SE and major defense players such as Safran SA and Airbus SE, may benefit from burgeoning markets driven by data-center expansion, heightened defense spending, and the energy transition. Nevertheless, political uncertainty continues to cast a shadow on expectations, complicating any prospects for a major recovery.

As 2026 approaches, both French and German stocks are positioned with a “fragile outlook,” according to Bloomberg Intelligence. Factors such as “stretched valuations, uneven earnings momentum, and mounting fiscal pressure” pose challenges that could hinder the anticipated profit rebound in these two major European economies.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169