Science

Investors Chase Nuclear Stocks as AI Demand Fuels Valuations

Investors are increasingly drawn to nuclear energy stocks, spurred by the growing demand for electricity driven by artificial intelligence (AI) technologies. Despite lacking revenue and regulatory approvals, Nano Nuclear Energy Inc. has seen its valuation soar past $2.3 billion. This surge appears to be fueled more by optimism than by solid fundamentals, as the company does not yet operate any power plants.

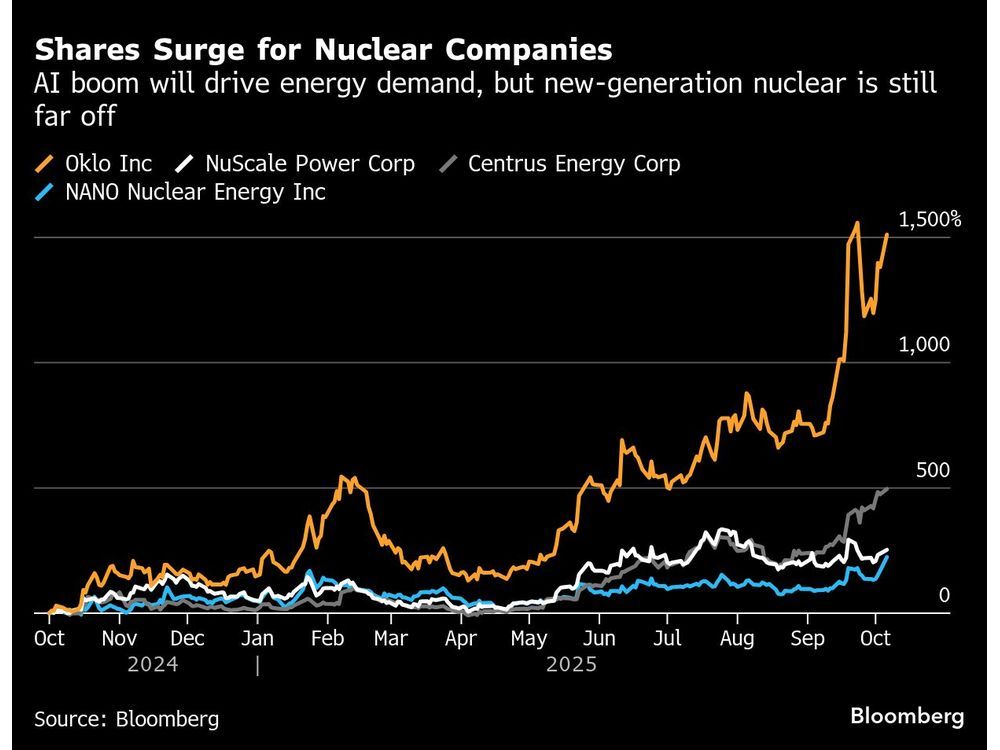

The excitement surrounding nuclear stocks extends to several companies in the sector. Oklo Inc., backed by OpenAI CEO Sam Altman, has experienced a staggering rise of over 1,000% in its share price within the past year. Similarly, NuScale Power Corp. and Nano Nuclear have both tripled in value, while Centrus Energy Corp., which specializes in reactor fuel, has increased by more than 400%.

Analysts Urge Caution Amid Euphoria

Despite the enthusiasm, some analysts caution that the current valuation levels may not be sustainable. Dimple Gosai, an analyst at Bank of America, downgraded both Oklo and NuScale, suggesting their valuations are “running ahead of reality.” She identified persistent regulatory challenges and an uncertain fuel supply as significant hurdles that could delay commercial projects into the next decade.

Gosai emphasized that the timeline for widespread nuclear deployment remains distant, likely not occurring until 2035 at the earliest. “Intellectually, it doesn’t make sense to buy the stocks right now,” she remarked. “Common sense must prevail at some point.”

While the demand for power is compelling, the obstacles are equally prominent. Analyst Paul Zimbardo from Jefferies noted that technology companies require immediate power solutions, which new nuclear technologies cannot currently provide. “Hyperscalers are willing to pay almost any price for power in the near term,” Zimbardo explained, highlighting the mismatch between current nuclear development timelines and immediate energy needs.

Nuclear Energy’s New Frontier: Small Modular Reactors

Nuclear energy has long been a key player in the electricity grid, but these emerging companies are taking a different approach. They are focusing on small modular reactors (SMRs), which are designed to be factory-manufactured and assembled on-site. This strategy aims to reduce costs and accelerate construction timelines, although it remains largely untested. Most existing SMR projects have been constructed in China and Russia, and it may take years before any are operational in the United States.

Data centers are increasingly driving electricity demand, with projections suggesting they could account for 7% of the country’s electricity consumption by the end of the decade, up from approximately 4% currently, according to BloombergNEF. This rising demand is also impacting other sectors, such as hydrogen production, where companies like Bloom Energy Corp. and Plug Power Inc. have seen significant increases in their stock prices.

Oklo recently began construction on its first commercial system in Idaho, aiming for operational status by 2028, pending approval from the Nuclear Regulatory Commission (NRC). The company plans to utilize a new type of uranium fuel known as high-assay low-enriched uranium (HALEU), which is not widely available and may pose a challenge to its timeline. Nonetheless, Oklo has been selected for two important programs from the U.S. Energy Department designed to accelerate the deployment of advanced nuclear plants.

Meanwhile, NuScale remains the only small modular reactor developer with an NRC-approved design, although its first project was canceled last year due to escalating costs. Nano Nuclear has not yet announced a construction timeline and has yet to submit its licensing application to the NRC. All three companies are still unprofitable, contrasting sharply with Centrus Energy, which is already generating revenue. Nevertheless, Centrus is also trading at a high valuation, approximately 67 times earnings, reflecting investor optimism about its future role in supplying HALEU fuel for the growing SMR sector.

As the demand for clean energy escalates, the perception of nuclear power is changing. Dan Leistikow, Vice President at Centrus Energy, stated, “Nuclear was, for many years, an undervalued and underappreciated asset. That’s beginning to change now as we face surging demand for electricity and huge new power requirements for AI and data centers.”

While the current fascination with nuclear stocks is palpable, it remains to be seen how these companies will navigate the regulatory and supply chain challenges ahead. Investors are looking to established nuclear operators, such as Constellation Energy Corp. and Vistra Corp., as safer bets while remaining hopeful about the long-term potential of nuclear energy in meeting increasing clean electricity needs.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169