Business

UK Households Hoard Cash as Christmas Spending Concerns Rise

UK households are increasingly choosing to save rather than spend, raising concerns about consumer activity as the Christmas season approaches. According to a recent analysis by former Bank of England rate-setter Michael Saunders, many Britons are feeling financially insecure due to the economic shocks experienced over the past five years. This shift in behavior suggests a growing reluctance to spend during what is typically a crucial trading period for retailers.

In his report from Oxford Economics, Saunders noted that saving rates have surged since before the pandemic, with many households prioritizing financial security over immediate consumption. The combination of higher interest rates, which make saving more appealing, and a heightened fear of not having enough funds for emergencies has led to a significant increase in the proportion of disposable income being saved.

Recent official figures indicate that the UK economy contracted for a second consecutive month in October, signaling potential challenges ahead. Retail sales have declined, and surveys reveal that consumers are hesitant to make purchases. This trend is particularly concerning as consumer spending accounts for around 60% of national output, yet it has stagnated for three years, hindering economic growth.

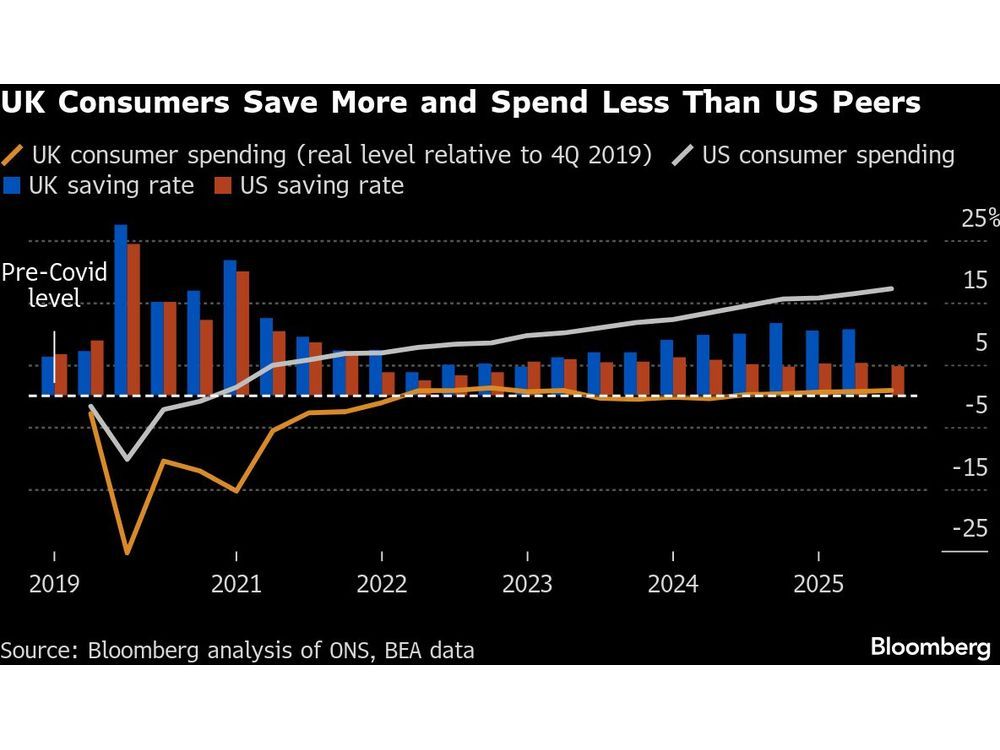

While the situation in the UK contrasts sharply with the United States, where consumer spending has driven robust economic expansion, the potential for a turnaround in household expenditures is critical for the government. Chancellor of the Exchequer Rachel Reeves relies on improved consumer spending to meet her budgetary plans and generate necessary tax revenues.

Saunders highlighted that households have been severely affected by the pandemic and the subsequent cost-of-living crisis, which saw inflation rates peak at over 11% in late 2022. Although average household savings have increased since the pandemic, a growing number of households report insufficient savings for emergencies. “Even though the median level of liquid assets is higher now than the pre-pandemic period, the share of households who say they don’t have enough savings for emergencies has risen markedly,” he stated.

The current saving rate in the UK exceeds 10%, approximately 2.5 percentage points above the long-term average. This heightened caution is particularly evident among individuals aged 25 to 55, renters, mortgagors, and those with limited savings. The Bank of England anticipates only a modest decline in saving rates in the upcoming years, with Governor Andrew Bailey acknowledging the prevailing “high level of caution” among consumers.

Looking ahead, the central bank is widely expected to lower interest rates, with a potential cut of 0.25% percentage points to 3.75% on December 18, 2023. Saunders believes rates will remain above pre-pandemic levels, leading to what he describes as “sluggish growth.” Financial markets predict only one additional rate cut after the December decision.

Research using data from the Bank of England’s annual NMG survey of approximately 6,000 households since 2010 reveals insights into the cautious consumption patterns in the UK. Interestingly, pensioners have largely escaped the financial insecurity affecting younger demographics. “Financial insecurity has fallen among the over 65s, probably because the triple lock has protected pension income,” Saunders explained. The triple lock guarantees that state pensions increase based on earnings growth, inflation, or a minimum of 2.5%.

Saunders also pointed out that historical patterns show increased precautionary saving following significant economic disruptions, as seen after the Great Depression in the 1930s and the inflation crisis in the UK during the 1970s.

A separate Consumer Outlook survey conducted by consulting firm RSM found that if given a one-off windfall of £5,000 (approximately $6,673.50), nearly 57% of respondents would opt to save it or pay down debt. Only 8% indicated they would spend it on Christmas gifts.

As the festive season nears, the prevailing sentiment among UK consumers underscores the challenges facing retailers and the broader economy. With spending likely to remain subdued, the impact on businesses during this critical time could be significant.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education4 months ago

Education4 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169