Business

Stocks Experience Significant Declines Amid Shutdown and Tariff Fears

Markets experienced a notable downturn on Friday, driven by a mix of political uncertainties and economic concerns. The potential for a government shutdown and renewed rumors of tariffs from former President Donald Trump contributed to a one-day selling spree that raised questions about the sustainability of recent market rallies. Although a single day of declines does not typically signify the end of a bullish trend, it has certainly shaken investor confidence.

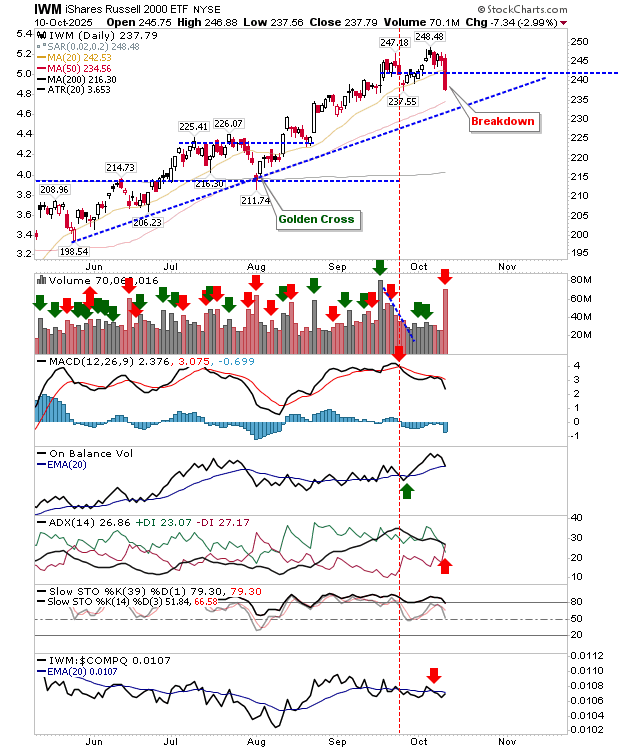

The Russell 2000 index fell sharply, breaking through its 20-day moving average (MA) and heading towards a critical test of its 50-day MA and rising trendline support. Analysts suggest that a breach of this support level could signify a more severe downturn and may lead to a test of the 200-day MA. Expectations for a bounce back exist, but the extent of any potential recovery remains uncertain.

The S&P 500 index has also faced challenges, cutting through its 20-day MA and trendline support with a test of its 50-day MA on the horizon. A new MACD trigger indicating a “sell” signal has compounded concerns following an earlier sell signal. The Nasdaq Composite endured the largest drop of the day, losing 3.5%, although it continues to retain some bullish momentum. Both the ADX and MACD indicators have shifted to “sell” triggers amid confirmed distribution patterns.

In the cryptocurrency market, Bitcoin ($BTCUSD) experienced a significant fluctuation, nearly covering its entire trading range within a single day. While this substantial movement may appear alarming, its impact is somewhat mitigated by the broader trading context. Technical indicators currently show a net negative outlook; however, unless Bitcoin dips below $107.5, a bearish reversal remains unlikely.

The semiconductor sector was particularly hard-hit, recording a loss exceeding 6% as it retreated to its 20-day MA. Investors are advised to closely monitor the Investor Sentiment Index, which has been oscillating since the last tariff-related market disturbances. This index has yet to determine whether it is entering a new phase of bullishness or bearishness.

While the market dynamics are shifting, analysts remain cautious about the potential for significant sell-offs. The swing low from April 2025 is generally not expected to be revisited, suggesting that any decline may be limited, possibly reaching around 5,500. In light of these developments, taking profits now to prepare for future opportunities in an oversold market may be a prudent strategy for investors.

As the political landscape continues to evolve, market participants will be watching closely to gauge how these uncertainties affect trading patterns in the weeks ahead.

-

Lifestyle1 month ago

Lifestyle1 month agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health2 months ago

Health2 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science2 months ago

Science2 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Education2 months ago

Education2 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology2 months ago

Technology2 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Science2 months ago

Science2 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology2 months ago

Technology2 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Technology5 days ago

Technology5 days agoDiscord Faces Serious Security Breach Affecting Millions

-

Science2 months ago

Science2 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Technology2 months ago

Technology2 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business2 months ago

Business2 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology6 days ago

Technology6 days agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Business2 months ago

Business2 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Science2 months ago

Science2 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Education2 months ago

Education2 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology2 months ago

Technology2 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Technology2 months ago

Technology2 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology2 months ago

Technology2 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology2 months ago

Technology2 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169

-

Technology2 months ago

Technology2 months agoArsanesia Unveils Smith’s Chronicles with Steam Page and Trailer

-

Science2 months ago

Science2 months agoNew Precision Approach to Treating Depression Tailors Care to Patients

-

Technology2 months ago

Technology2 months agoHumanoid Robots Compete in Hilarious Debut Games in Beijing

-

Business2 months ago

Business2 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Health2 months ago

Health2 months agoGiant Boba and Unique Treats Take Center Stage at Ottawa’s Newest Bubble Tea Shop