Business

Citadel Expands Commodity Trading Operations to Australia

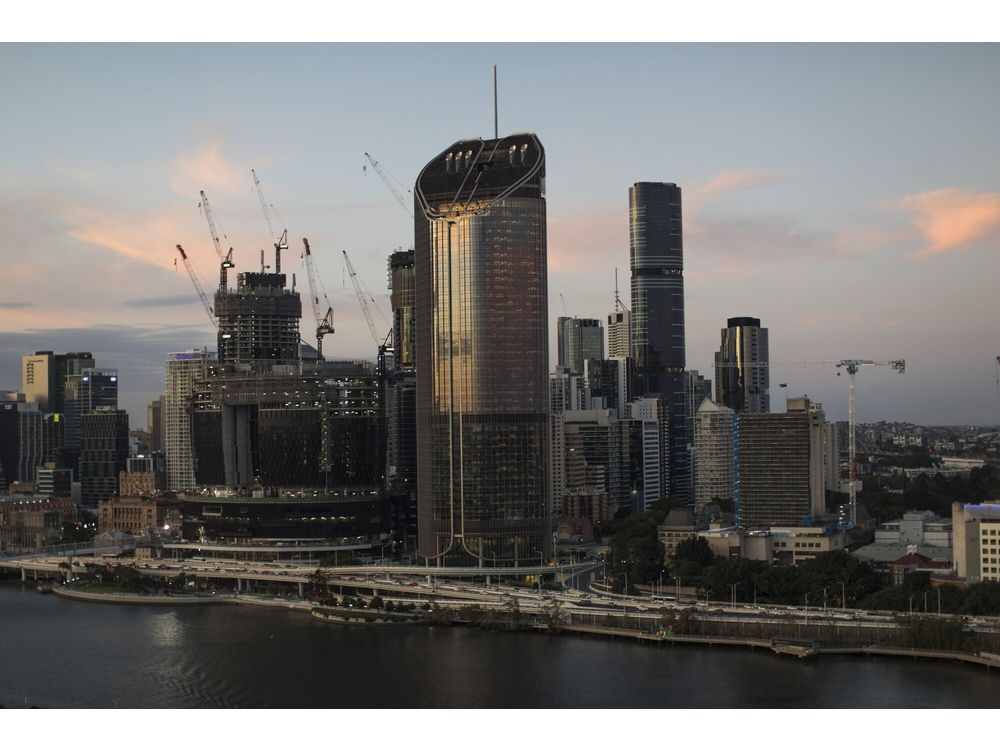

Citadel, the hedge fund firm led by Ken Griffin, is broadening its reach in the commodities market by launching operations in Australia. The firm has hired Keith Handbury, a senior trader from Shell Plc, who will assume the role of portfolio manager in Brisbane starting next month. Handbury will focus on trading electricity-related commercial paper and derivatives, as part of Citadel’s strategy to enhance its capabilities in the Asian commodities sector.

This move marks a significant step for Citadel, which manages approximately $68 billion in assets and has built one of the largest investment businesses in commodities over the past 23 years. The company has a global commodities trading group comprising more than 260 investment professionals and nearly 100 engineers operating out of 12 locations worldwide.

According to a source familiar with the situation, Handbury’s addition will be complemented by the hiring of an analyst in the same month, with plans for further team expansion. The firm’s focus is on assisting energy producers and consumers in managing risks across a variety of markets, including natural gas, power, environmental products, and weather.

Strategic Growth in Asia

Citadel’s expansion into Australia follows its initial foray into Asia, which began in Singapore. The firm has been actively recruiting talent in the region, notably hiring Hironao Sakata, the former head of Japan commodities sales at Morgan Stanley MUFG Securities Co., last year. Additionally, Citadel acquired Energy Grid Corp, a Tokyo-based company specializing in trading and selling power products, further enhancing its capabilities in this sector.

The competitive landscape in the Asia-Pacific region is intensifying. Other firms are also ramping up their activities in commodities trading. For instance, Balyasny Asset Management is reportedly looking to add portfolio managers to its natural gas and power team in Singapore. Similarly, Qube Research & Technologies has been actively hiring for the Australian power market.

Despite these advancements, Citadel declined to comment on the specifics of the hires or the expansion strategy in an emailed statement. Nonetheless, the firm’s aggressive approach signals its commitment to establishing a formidable presence in the Australian commodities market, which is expected to grow in significance in the coming years.

Overall, Citadel’s expansion reflects a broader trend of hedge funds and investment firms seeking to capitalize on opportunities in the dynamic commodities sector within Asia and beyond.

-

Education2 months ago

Education2 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Science3 months ago

Science3 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Health3 months ago

Health3 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science3 months ago

Science3 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology3 months ago

Technology3 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Technology1 month ago

Technology1 month agoDiscord Faces Serious Security Breach Affecting Millions

-

Business2 months ago

Business2 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology3 months ago

Technology3 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business3 months ago

Business3 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology1 month ago

Technology1 month agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology3 months ago

Technology3 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology3 months ago

Technology3 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology3 months ago

Technology3 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science3 months ago

Science3 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology3 months ago

Technology3 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169

-

Technology3 months ago

Technology3 months agoDiscover the Relaxing Charm of Tiny Bookshop: A Cozy Gaming Escape