Business

Bank of England Holds Interest Rates Amid Economic Uncertainty

On February 5, 2025, the Bank of England announced it would maintain interest rates at 3.75%, following a closely contested decision by its monetary policy committee. The nine-member committee voted five to four to keep borrowing costs steady, a move that reflects ongoing caution among policymakers in response to rising inflation and a less optimistic economic outlook.

The decision comes as inflation, measured by the Consumer Price Index (CPI), increased slightly to 3.4% in December 2025, remaining well above the Bank’s target of 2.0%. In addition to this, the Bank has revised its economic growth forecasts downward for 2026, reducing the expected growth from 1.2%% to 0.9%%. This economic context suggests that further rate cuts may be on the horizon, particularly as the unemployment rate is projected to rise from an initial forecast of 5.0%% to 5.3%%.

Governor Andrew Bailey indicated that while there might be “some further reduction” in rates later this year, he does not expect them to return to the exceptionally low levels witnessed at the beginning of the COVID-19 pandemic. He emphasized that these low rates were a response to unique economic conditions stemming from the financial crisis.

In a notable commentary, Bailey mentioned the impact of artificial intelligence on employment trends in the UK, referencing research published on the Bank’s Bank Underground blog. He noted that AI is influencing hiring patterns, with mixed forecasts regarding its effects on job availability.

Market Reactions and Economic Implications

Reactions from industry experts suggest that the decision to hold rates steady may not dampen market momentum. Richard Merrett, Managing Director of mortgage adviser Alexander Hall, stated that the market has seen increased activity following the rate cut in December. He noted that buyers are approaching the new year with renewed confidence, resulting in the average homebuyer saving around £1,000 on mortgage repayments compared to a year ago.

Similarly, Jonathan Samuels, CEO of specialist lender Octane Capital, expressed optimism, indicating that maintaining the base rate provides consistency for both lenders and borrowers. He remarked, “No news is good news in the grand scheme of things,” highlighting that a stable base rate encourages lenders to offer competitive product ranges while allowing borrowers to plan with greater certainty.

The decision by the Bank of England is significant not only for its immediate implications on borrowing costs but also for the broader economic environment in the UK. As Prime Minister Keir Starmer navigates challenges, including the ongoing fallout from the Peter Mandelson scandal, the Bank’s cautious approach may reflect a desire to stabilize the economy amidst fluctuating inflation and growth forecasts.

Looking ahead, the Bank of England’s decision to maintain interest rates signals a careful balancing act as it seeks to navigate economic uncertainties while fostering a supportive environment for both consumers and investors. The next few months will be crucial in determining whether inflationary pressures will ease and in shaping the UK’s economic landscape moving forward.

-

Education5 months ago

Education5 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science6 months ago

Science6 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle5 months ago

Lifestyle5 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health6 months ago

Health6 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science6 months ago

Science6 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology6 months ago

Technology6 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Business2 months ago

Business2 months agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Technology3 weeks ago

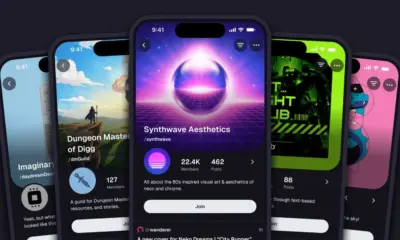

Technology3 weeks agoDigg Relaunches as Founders Kevin Rose and Alexis Ohanian Join Forces

-

Top Stories2 months ago

Top Stories2 months agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Education6 months ago

Education6 months agoRed River College Launches New Programs to Address Industry Needs

-

Business5 months ago

Business5 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology6 months ago

Technology6 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Education6 months ago

Education6 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology4 months ago

Technology4 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Business6 months ago

Business6 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science6 months ago

Science6 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle4 months ago

Lifestyle4 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business6 months ago

Business6 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business1 month ago

Business1 month agoNvidia and AMD CEOs Unveil AI Innovations at CES 2026

-

Business4 months ago

Business4 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Top Stories4 months ago

Top Stories4 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Business6 months ago

Business6 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology6 months ago

Technology6 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase