Top Stories

Crypto Miners Shift Focus to AI, Leaving Bitcoin Behind

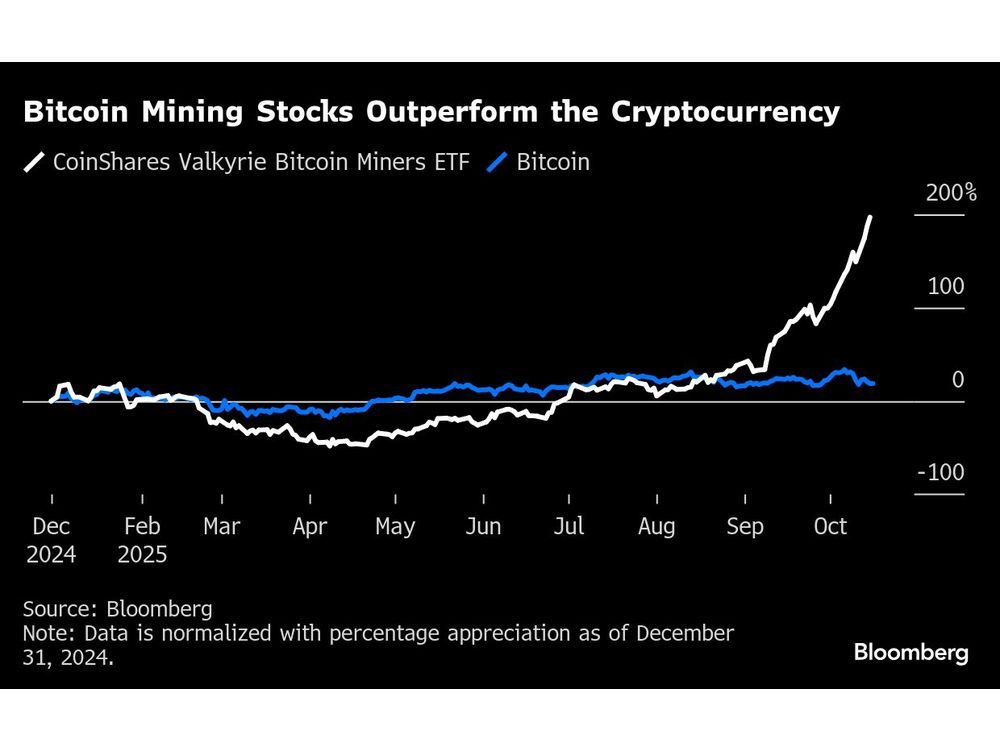

Shares of cryptocurrency mining companies are outpacing Bitcoin, demonstrating a significant shift in focus towards artificial intelligence (AI) and high-performance computing (HPC). This transition comes as miners pivot from their traditional role in Bitcoin production to becoming tech infrastructure firms.

The recent surge in performance reflects broader industry changes. A fund tracking listed mining firms has seen its value increase by over 150% year-to-date, highlighting a departure from past cycles when miners predominantly benefited from rising Bitcoin prices. As John Todaro, an analyst at Needham & Co., noted, “Investors are almost exclusively valuing Bitcoin miners for their HPC/AI opportunities at this point.”

Despite Bitcoin experiencing a 14% increase in value during 2025, nearing its all-time high of almost $126,000, miners are emerging as the primary beneficiaries of this year’s crypto resurgence. Companies such as Cipher Mining Inc. and IREN Ltd. have seen their stock prices soar by approximately 300% and 500%, respectively. This remarkable growth is attributed to their strategic pivot from Bitcoin mining to AI infrastructure development.

Miners Embrace AI and HPC Opportunities

In a notable development earlier this year, Cipher Mining entered a $3 billion colocation agreement with Fluidstack, a company partially backed by Google. This deal guarantees $1.4 billion in lease obligations in exchange for a 5.4% equity stake, marking a significant step towards merging crypto mining with AI technologies.

Similarly, IREN has successfully closed a $1 billion offering of convertible notes, positioning itself for future growth. Other miners, such as TeraWulf Inc., announced plans to issue $3.2 billion in senior secured notes to expand their Lake Mariner data center in Barker, New York.

The Singapore-based Bitdeer Technologies Group also reported a nearly 30% increase in shares after announcing plans to convert major mining sites into AI data centers. Their facility in Clarington, Ohio, which boasts a capacity of 570 megawatts, could generate annual revenues exceeding $2 billion by the end of 2026, should the transition be successful.

Impact of Bitcoin Halving and Market Dynamics

The pivot towards AI follows the most recent Bitcoin halving in 2024, which reduced miner rewards from 6.25 to 3.125 Bitcoin. This reduction, compounded by rising network difficulty and declining transaction volumes, has pressured profit margins for miners. Even recent highs in Bitcoin prices have not alleviated the economic strains faced by miners.

This strategic shift means that many companies will slow or pause their expansion of Bitcoin’s hashrate, which measures the total mining capacity of the industry. Wolfie Zhao, an analyst at TheMinerMag, remarked that firms such as Riot Platforms Inc., IREN, and Bitfarms have indicated they will not increase their hashrate in the near future.

“The focus is shifting from ‘how much hashrate can we add’ to ‘how efficiently can we utilize our energy footprint,’” he stated. With Bitcoin’s hashprice at historic lows, the transition towards AI and HPC was almost expected.

According to Todaro, “The revenue per megawatt and EBITDA margins are far higher for HPC and AI colocation than for mining.” As a result, many capital markets are currently rewarding AI-focused data centers with significantly higher valuations compared to traditional Bitcoin miners.

As the lines between cryptocurrency mining and AI technology continue to blur, the industry is witnessing a profound transformation that could redefine the future of both sectors. Miners are not just adapting; they are positioning themselves at the forefront of a technological evolution that promises to reshape their business models for years to come.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Top Stories2 months ago

Top Stories2 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169