Business

XPeng Surpasses Q3 Profit Expectations While Revenue Falls Short

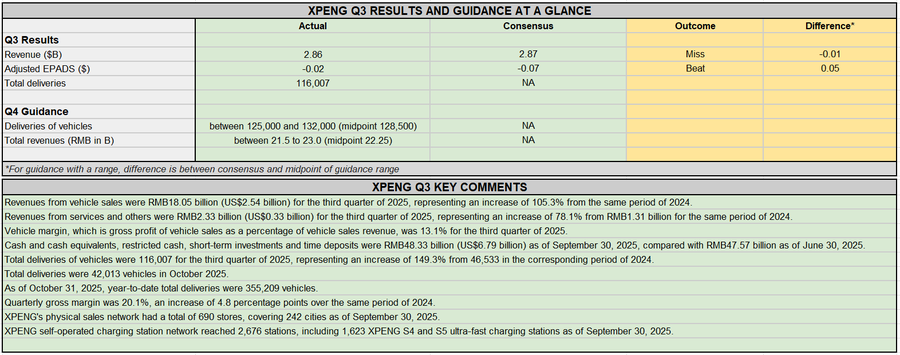

XPeng, the Chinese electric vehicle manufacturer, reported its financial results for the third quarter of 2023, showcasing a notable profit that exceeded analysts’ expectations. The company announced a net income of $1.5 billion, driven by a significant surge in vehicle deliveries. However, despite this profit success, XPeng fell short on revenue, raising questions about its growth trajectory in an increasingly competitive market.

Deliveries for the quarter soared by an impressive 149.3% year-over-year, highlighting XPeng’s robust demand amidst a booming electric vehicle sector in China. The company delivered 43,000 vehicles during Q3 2023, compared to just over 17,000 in the same period last year. This remarkable growth underscores the shift towards electric mobility, especially as more consumers prioritize sustainable transportation options.

Despite the positive delivery figures, XPeng’s revenue for the quarter came in lower than anticipated. Analysts had predicted revenue figures closer to $1.8 billion, but the company reported only $1.4 billion. This discrepancy raises concerns about XPeng’s pricing strategies and market positioning as it navigates the challenges posed by both domestic and international competitors.

The company attributed its profit increase to improved operational efficiencies and cost management strategies. XPeng has focused on streamlining its production processes while investing in research and development for its next-generation vehicles. The impact of these measures has been reflected in the company’s financial results, although the lower revenue figures suggest that there may be headwinds ahead.

Market Reaction and Future Outlook

XPeng’s mixed results elicited varied reactions from investors and market analysts. While the jump in deliveries is a positive indicator of consumer interest, the revenue shortfall could impact the company’s stock performance moving forward. Analysts remain cautious, suggesting that XPeng must enhance its revenue generation strategies to sustain long-term growth.

Market analysts have noted that XPeng is competing in a challenging landscape filled with established players and new entrants in the electric vehicle market. Companies like Tesla and NIO continue to dominate, while newer firms are rapidly gaining traction. As XPeng prepares for the upcoming quarters, it will need to focus on differentiating its offerings and maintaining its production scale.

XPeng is also navigating regulatory challenges and shifts in government policies regarding electric vehicles in China. As the Chinese government continues to tighten regulations and encourage innovation in the sector, XPeng may need to adapt its strategies to comply with these changes while still appealing to consumers.

In conclusion, XPeng’s ability to deliver impressive growth in vehicle sales reflects a strong market presence, yet the revenue shortfall highlights the need for strategic adjustments. The company’s performance in the coming quarters will be crucial in determining its position in the competitive electric vehicle landscape. Stakeholders will be closely monitoring XPeng’s next moves as it seeks to sustain its momentum and enhance its market share.

-

Education2 months ago

Education2 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Science3 months ago

Science3 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Health3 months ago

Health3 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science3 months ago

Science3 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology3 months ago

Technology3 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Technology1 month ago

Technology1 month agoDiscord Faces Serious Security Breach Affecting Millions

-

Business2 months ago

Business2 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology3 months ago

Technology3 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business3 months ago

Business3 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology1 month ago

Technology1 month agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology3 months ago

Technology3 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology3 months ago

Technology3 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Technology3 months ago

Technology3 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Science3 months ago

Science3 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology3 months ago

Technology3 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169

-

Technology3 months ago

Technology3 months agoDiscover the Relaxing Charm of Tiny Bookshop: A Cozy Gaming Escape