Business

US Job Growth Expected to Remain Weak Ahead of Fed Meeting

US job growth is anticipated to remain subdued in September, with economists predicting an addition of only 50,000 jobs. This figure aligns with the average over the past three months, as the unemployment rate is expected to hold steady at 4.3%, which represents an almost four-year high. This lackluster performance highlights an ongoing sluggish trend in the labor market.

The upcoming report from the Bureau of Labor Statistics is scheduled for release on October 6, 2025. However, its publication is at risk if lawmakers fail to reach an agreement on a funding bill before the end of the fiscal year on October 1. A government shutdown would suspend federal economic reports, potentially delaying this key data.

Federal Reserve’s Interest Rate Decisions Uncertain

Should the report be released as planned, it will provide crucial insights for Federal Reserve policymakers regarding employers’ demand for labor. Recent cuts to interest rates were made this month in response to concerns about the fragility of the job market, marking the first reduction since 2025. Investors are now bracing for potential further cuts during the Fed’s upcoming two-day meeting, which concludes on October 29.

“Bloomberg Economics expects nonfarm payrolls for September to add a net 54,000 jobs. The improvement in net hiring likely came from leisure and hospitality, as temperate weather and a positive wealth effect from the summer stock-market rally drove spending on discretionary services.” — Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins, economists

As labor demand gradually diminishes, many companies are seeking strategies to offset rising costs, including higher import duties. Additionally, a separate government report is expected to show that August job openings were at one of the lowest levels since 2021, further indicating a cooling labor market.

Upcoming Economic Indicators and Global Context

In the coming week, the Institute for Supply Management will release its September surveys of manufacturers and service providers, which may provide further context regarding economic health. Investors remain alert for any last-minute developments ahead of the potential government shutdown, as these could have significant repercussions on economic stability.

Global economic indicators will also be prominent. The Bank of Canada will release deliberations that led to its recent quarter-point rate cut, the first since March 2025. This may offer insights into future monetary policy decisions, particularly as markets consider the likelihood of another rate adjustment in October.

Across Europe, inflation data from multiple countries, including Spain, France, Germany, and Italy, will be released, shedding light on the overall economic climate in the eurozone. Forecasts suggest an inflation rate of 2.2%, the highest in five months.

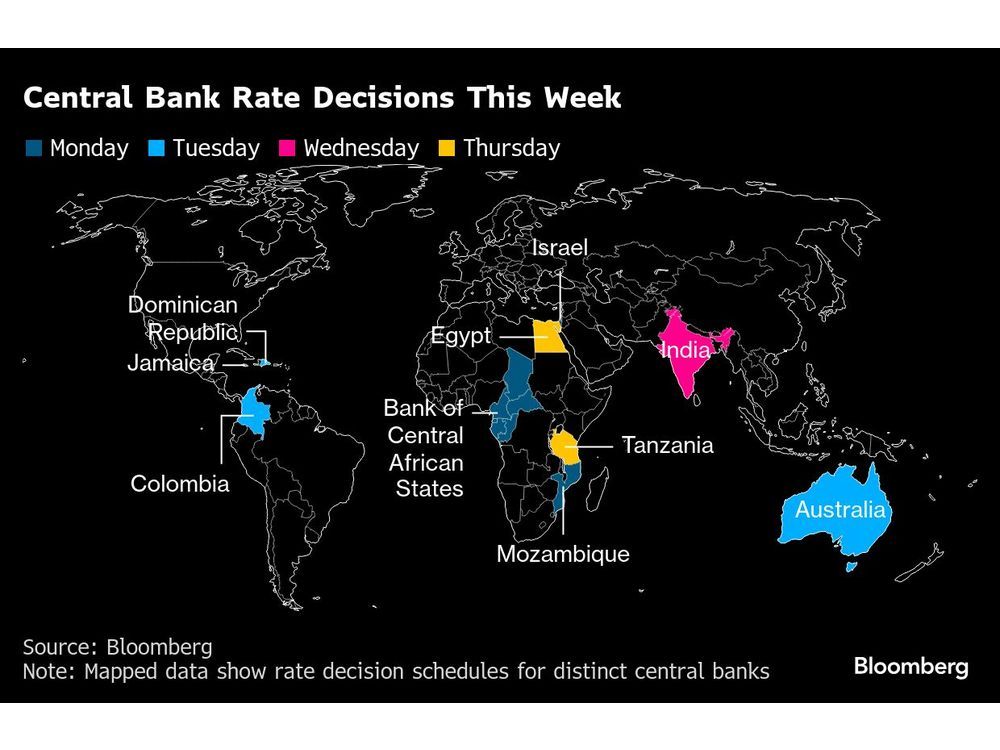

As global central bankers convene to discuss monetary policy, attention will also focus on the Reserve Bank of Australia, which is expected to maintain its benchmark rate, and the Reserve Bank of India, which may lower its rate to 5.25%.

In summary, the upcoming job report and central bank meetings will be pivotal in shaping economic expectations both in the US and globally. Investors and policymakers alike will be keenly observing these developments as they navigate an uncertain economic landscape.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology4 months ago

Technology4 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education4 months ago

Education4 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education4 months ago

Education4 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Education4 months ago

Education4 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science4 months ago

Science4 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Business4 months ago

Business4 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Top Stories3 months ago

Top Stories3 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169