Business

U.S. Military Invests $35 Million in Canadian Mining Venture

Last week, Vancouver-based Trilogy Metals announced a significant agreement with the U.S. Department of Defense. The military arm of the United States plans to purchase a 10 percent stake in the mining company, amounting to more than $35 million. This investment is aimed at developing a 2,000-square-kilometre mineral deposit located in remote northern Alaska, highlighting the strategic importance of the Upper Kobuk Mineral Projects.

Tony Giardini, president and CEO of Trilogy, stated that the deal underscores the project’s potential to support U.S. energy, technology, and national security priorities. Following the announcement, Trilogy’s stock values experienced a notable surge, tripling in response to the news. Attempts to secure a comment from Trilogy were unsuccessful.

This is not the first time the U.S. government has invested in a British Columbia mining company. On October 1, the Department of Energy revealed a 5 percent stake in Lithium Americas, which includes a stake in its Thacker Pass lithium mine in Nevada. Earlier this year, the Pentagon also made headlines by investing in MP Materials, which operates the only active rare earth elements mine in the United States.

According to Werner Antweiler, an associate professor in strategy and business economics at the University of British Columbia Sauder School of Business, government investment in companies is relatively rare. He explained that while governments often support industries deemed crucial through loans or guarantees, direct ownership is uncommon in Western nations.

The mining companies targeted by the U.S. government share a common focus on critical minerals, which play a vital role in the global energy transition. These materials are essential for a range of technologies, from electric vehicle batteries to renewable energy infrastructure, and are also crucial in military applications. The current geopolitical landscape, marked by trade tensions and conflicts in regions such as Ukraine and the Middle East, has intensified U.S. interest in securing a domestic supply of these materials.

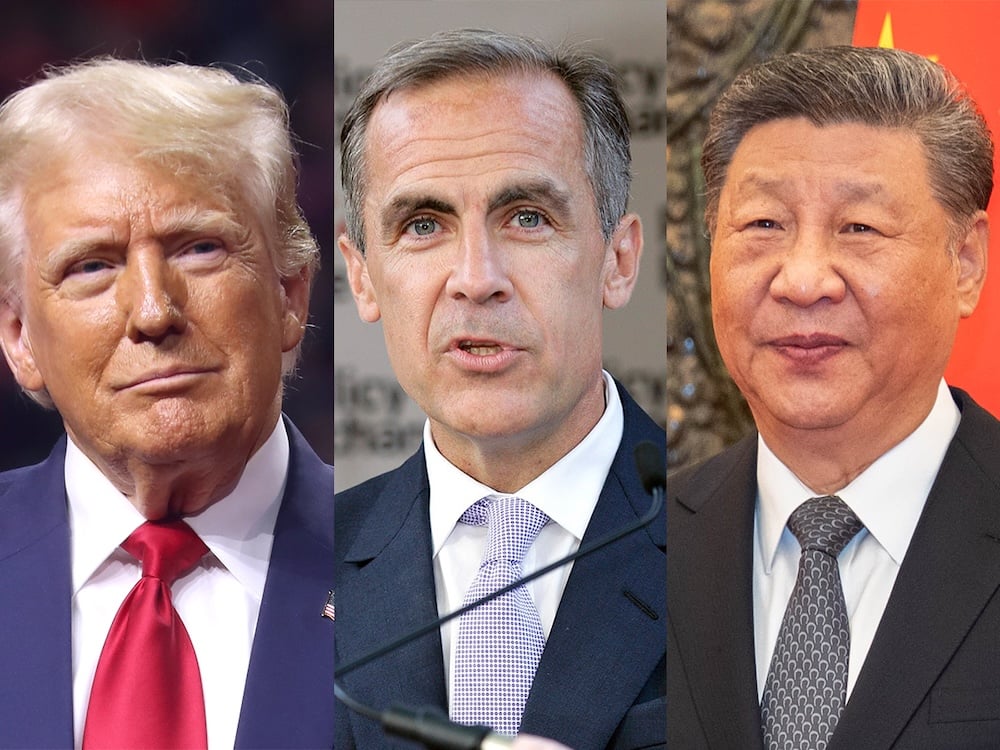

China’s dominance in critical mineral production—accounting for approximately 90 percent of global rare earth elements—has raised alarm in the U.S., particularly as the country has restricted exports in recent months. This situation has prompted U.S. officials, including former President Donald Trump, to pursue various strategies to secure critical mineral supplies, including controversial discussions about annexing Canada and acquiring Greenland.

The rising military expenditure, which reached an unprecedented $2.7 trillion globally last year, has also fueled interest in critical minerals. The United Nations noted that this figure represents a 10 percent increase from the previous year, marking the steepest rise since the Cold War. In light of this, Canada has pledged to boost its defense spending to 5 percent of its GDP over the next decade, reflecting a shift towards increasing military capabilities.

This surge in military spending has been a boon for the natural resource sector, particularly for companies involved in mining critical minerals. These materials are integral to the production of advanced military equipment, including F-35 fighter jets manufactured by Lockheed Martin. In a recent interview, Scott Eldridge, CEO of Vancouver-based Military Metals, emphasized the influx of capital into the mining sector, particularly from the U.S., and predicted that greater investments from Canada and the European Union are on the horizon.

Simultaneously, Canada has enhanced its support for the critical minerals industry, launching the Critical Minerals Infrastructure Fund two years ago to provide up to $1.5 billion in funding. In March, the government allocated $50 million specifically for critical minerals developers to bolster energy security by reducing reliance on authoritarian regimes.

One notable project gaining attention is the Wicheeda project in British Columbia, which boasts one of the richest rare earth deposits globally. Mark Tory, who recently became president and CEO of Defense Metals, highlighted the project’s potential to contribute significantly to the critical mineral supply chain. The Wicheeda site is particularly valuable for its neodymium and praseodymium content, which are essential for manufacturing permanent magnets used in both renewable energy technologies and military equipment.

Defense Metals has also engaged with the U.S. government, bringing on strategic advisers with strong ties to national defense. Tory indicated that the company is open to any potential funding opportunities from the U.S. and is currently preparing to enter the environmental assessment process by early 2026.

Despite the optimistic outlook for the mining sector, there are growing concerns about the ethical implications of critical minerals. Activists, including Nikki Skuce, co-chair of the BC Mining Law Reform network, have raised alarms about the lack of transparency in the critical minerals supply chain. She emphasized the need for clarity on whether the mined materials are contributing to renewable energy or military conflict, noting that the environmental assessment process does not account for the end-use of critical minerals.

In conclusion, while U.S. investments in Canadian mining companies raise questions about the motives behind securing critical minerals, experts like Antweiler caution that the relatively minor stakes do not pose an immediate threat to Canadian sovereignty. Nonetheless, the growing focus on these resources amid a turbulent geopolitical landscape highlights the complexities of balancing energy security, military needs, and ethical considerations in resource extraction.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Top Stories2 months ago

Top Stories2 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169