Business

Trump’s Venezuela Strategy Could Impact Alberta’s Oil Demand

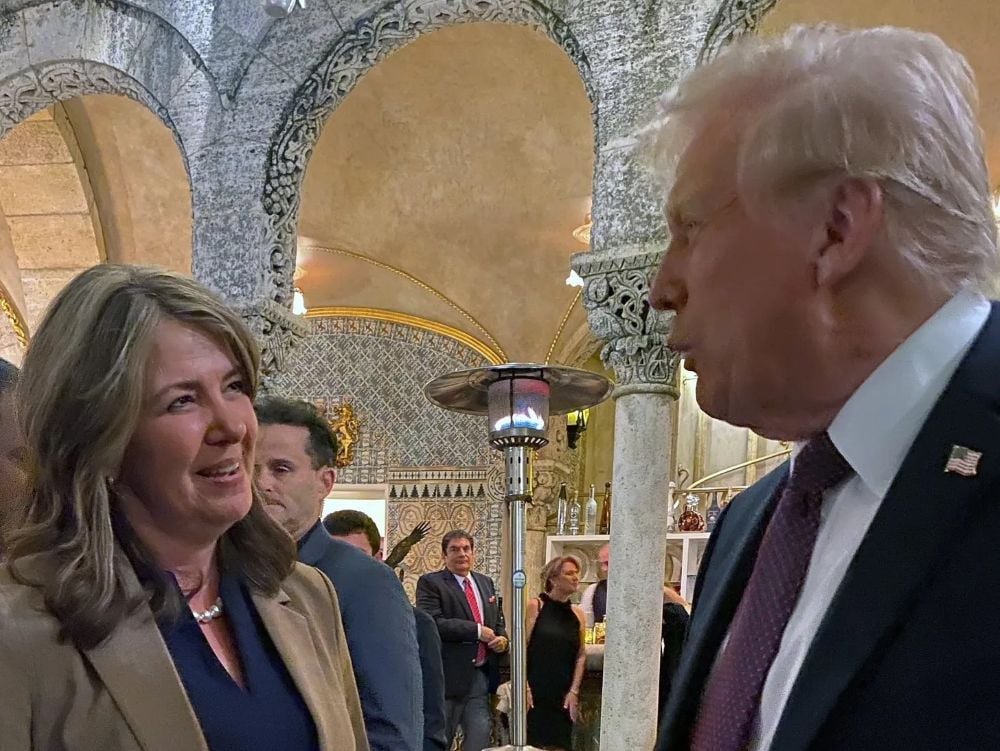

The recent political maneuvering by former President Donald Trump regarding Venezuela has raised significant concerns for Alberta’s oil industry. Trump’s plans to increase the import of Venezuelan heavy oil could drastically affect the demand for bitumen sourced from the province’s oilsands, a critical component of Alberta’s economy.

Trump’s administration is reportedly considering lifting sanctions on Venezuelan oil exports as part of a strategy to counter rising fuel prices in the United States. This move, aimed at stabilizing U.S. markets, could lead to a substantial influx of Venezuelan heavy oil into the U.S., which, in turn, would likely diminish the market for Canadian bitumen.

Implications for Alberta’s Economy

Alberta’s oilsands have long been a cornerstone of the province’s economy, contributing significantly to job creation and economic growth. In 2022, the oilsands sector generated approximately $12.6 billion in revenue, with bitumen production accounting for a large portion of this figure. If U.S. demand shifts towards Venezuelan heavy oil, Alberta could face severe economic repercussions, including job losses and reduced investment in the oilsands.

Industry analysts warn that the potential for increased Venezuelan oil in U.S. markets could lead to a price reduction for Canadian bitumen. Currently, Alberta’s oil is priced higher than Venezuelan heavy oil, which is often cheaper due to lower production costs and favorable supply conditions. A shift in demand could prompt Alberta producers to lower their prices, impacting their profit margins.

The province’s government is closely monitoring the situation and is expected to engage in discussions with industry leaders to strategize how to mitigate potential negative effects. According to Alberta’s Energy Minister, Brian Jean, “We must ensure that our oil producers remain competitive and that Alberta’s economy continues to thrive.”

Future Considerations

The situation remains fluid as Trump’s policies could change based on shifting political dynamics. Analysts emphasize the importance of understanding the long-term implications of U.S. energy policy, especially concerning sanctions and foreign oil imports.

As of March 2024, Alberta’s energy sector is at a crossroads. The province has made strides in diversifying its energy portfolio, investing in renewable energy sources and technology to reduce greenhouse gas emissions. However, the reliance on the oilsands remains significant, and any substantial drop in demand could hinder these efforts.

The potential for increased Venezuelan oil imports necessitates a proactive response from the Alberta government and the oil industry. Collaboration and innovation will be key factors in navigating this complex landscape. As the situation unfolds, stakeholders will need to adapt to ensure the continued vitality of Alberta’s economy in the face of changing U.S. energy policies.

-

Education4 months ago

Education4 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science5 months ago

Science5 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle4 months ago

Lifestyle4 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health5 months ago

Health5 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science5 months ago

Science5 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology5 months ago

Technology5 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Education5 months ago

Education5 months agoRed River College Launches New Programs to Address Industry Needs

-

Business4 months ago

Business4 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology5 months ago

Technology5 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Top Stories4 weeks ago

Top Stories4 weeks agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Technology3 months ago

Technology3 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education5 months ago

Education5 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Business1 month ago

Business1 month agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Business5 months ago

Business5 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science5 months ago

Science5 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle3 months ago

Lifestyle3 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business5 months ago

Business5 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Business5 months ago

Business5 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology5 months ago

Technology5 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Top Stories4 months ago

Top Stories4 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Top Stories3 months ago

Top Stories3 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Technology5 months ago

Technology5 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge