Business

Treasury Yields Shift as Mortgage Rates Hit Lowest Since 2024

The U.S. Treasury yields experienced notable movements on September 19, 2025. The yield on the 10-year note closed at 4.14%, while the 2-year note finished at 3.57%, and the 30-year note ended at 4.75%. These figures reflect a broader trend in the bond market, indicating shifts in investor sentiment and economic outlook.

In a related development, the Freddie Mac Weekly Primary Mortgage Market Survey reported that the average rate for a 30-year fixed mortgage dropped to 6.26%. This marks the lowest rate recorded since October 2024, providing some relief for potential homebuyers facing high borrowing costs in recent years.

Market Reactions and Implications

The increase in Treasury yields often signals changes in economic conditions or investor expectations regarding inflation and interest rates. The higher yield on the 30-year note may indicate a cautious outlook among investors regarding long-term economic stability.

Lower mortgage rates can stimulate the housing market by making home loans more affordable. With the 30-year mortgage rate now at its lowest since last year, many analysts expect a potential uptick in homebuying activity. This could provide a much-needed boost to the real estate sector, which has faced challenges from previous high-interest rates.

Investors and financial analysts closely monitor these yields, as they influence various financial instruments and the overall economic landscape. For instance, fluctuations in Treasury yields can affect everything from mortgage rates to corporate borrowing costs, creating a ripple effect across the economy.

Future Outlook

Looking ahead, the dynamics between Treasury yields and mortgage rates will remain a focal point for economists and investors alike. The interplay between inflation, Federal Reserve policies, and market sentiment will continue to shape expectations in the bond market.

As the financial environment evolves, stakeholders will watch for further changes in Treasury yields and their impact on consumer behavior, particularly in the housing market. The recent decline in mortgage rates could signify a shift towards a more favorable borrowing environment, potentially revitalizing sectors that rely heavily on consumer financing.

In summary, the movements in Treasury yields on September 19, 2025, alongside the drop in mortgage rates, suggest a critical moment for both the bond and housing markets. Investors and potential homebuyers alike are keenly aware of these trends, which could influence financial decisions in the months to come.

-

Education5 months ago

Education5 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science6 months ago

Science6 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle5 months ago

Lifestyle5 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health6 months ago

Health6 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science6 months ago

Science6 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology6 months ago

Technology6 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Business2 months ago

Business2 months agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Technology3 weeks ago

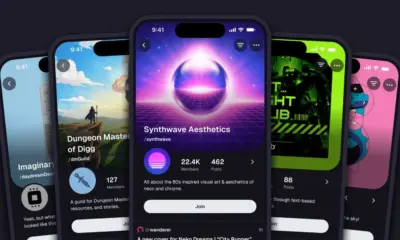

Technology3 weeks agoDigg Relaunches as Founders Kevin Rose and Alexis Ohanian Join Forces

-

Top Stories2 months ago

Top Stories2 months agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Education6 months ago

Education6 months agoRed River College Launches New Programs to Address Industry Needs

-

Business5 months ago

Business5 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology6 months ago

Technology6 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Education6 months ago

Education6 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology4 months ago

Technology4 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Business6 months ago

Business6 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science6 months ago

Science6 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle4 months ago

Lifestyle4 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business6 months ago

Business6 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business1 month ago

Business1 month agoNvidia and AMD CEOs Unveil AI Innovations at CES 2026

-

Business4 months ago

Business4 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Business6 months ago

Business6 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Top Stories4 months ago

Top Stories4 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Technology6 months ago

Technology6 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase