Business

S&P 500 Reaches Record 6,468 on Strong Earnings and Guidance

The S&P 500 has achieved a significant milestone in 2025, closing at a record high of 6,468. This surge is attributed to a combination of robust earnings revisions and an exceptional second-quarter reporting season. Unlike previous rallies that may have relied on multiple expansions, this increase is firmly rooted in improving corporate fundamentals.

Positive Earnings Revisions Fuel Market Optimism

Earnings estimates are being revised upwards at the most rapid pace since late 2021, indicating widespread optimism among analysts. Notably, companies are also enhancing their own forward guidance, with the ratio of positive to negative outlooks reaching a four-year high, especially for near-term forecasts. This shift has bolstered market momentum, positioning full-year 2025 earnings growth at an anticipated 10.3%, with a projected 8% increase in Q3 year-over-year.

The trends highlight a significant turnaround in corporate confidence. The improved earnings outlook reflects a broader sentiment that could sustain the market’s upward trajectory.

Exceptional Q2 Earnings Reports Exceed Expectations

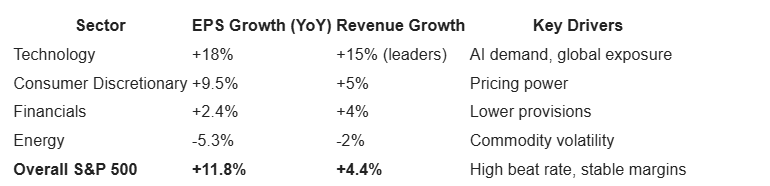

With nearly all S&P 500 companies having reported, second-quarter earnings growth stood at an impressive 11.8% year-over-year, nearly tripling the initial expectation of 4%. This marks the third consecutive quarter of double-digit growth, showcasing a resilient corporate landscape. A remarkable 82% of companies surpassed earnings estimates, one of the highest rates on record.

Revenue growth for the quarter increased by 4.4%, driven predominantly by the technology and consumer discretionary sectors. Importantly, profit margins remained stable at 12.1%, countering concerns about potential erosion. This stability is attributed to companies’ adeptness in managing costs, adjusting supply chains, and effectively passing on price increases to consumers.

The data suggests not only a strong recovery from previous economic downturns but also a proactive approach by corporations to navigate ongoing challenges. As the market continues to respond positively to these developments, investors remain optimistic about sustained growth in the latter half of the year.

In conclusion, the combination of strong earnings growth, upward revisions in guidance, and robust corporate performance highlights a promising outlook for the S&P 500 in 2025. As the index sets new records, it reflects the underlying strength of the economy and the resilience of the corporate sector.

-

Education4 months ago

Education4 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science5 months ago

Science5 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle4 months ago

Lifestyle4 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health5 months ago

Health5 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Science5 months ago

Science5 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology5 months ago

Technology5 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Education5 months ago

Education5 months agoRed River College Launches New Programs to Address Industry Needs

-

Business4 months ago

Business4 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology5 months ago

Technology5 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Top Stories4 weeks ago

Top Stories4 weeks agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Technology3 months ago

Technology3 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education5 months ago

Education5 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Business1 month ago

Business1 month agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Business5 months ago

Business5 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science5 months ago

Science5 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle3 months ago

Lifestyle3 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business5 months ago

Business5 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business5 months ago

Business5 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Business3 months ago

Business3 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Technology5 months ago

Technology5 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Top Stories4 months ago

Top Stories4 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology5 months ago

Technology5 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Top Stories3 months ago

Top Stories3 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season