Business

Credit Suisse’s Debt Swaps Find New Applications Amid Global Challenges

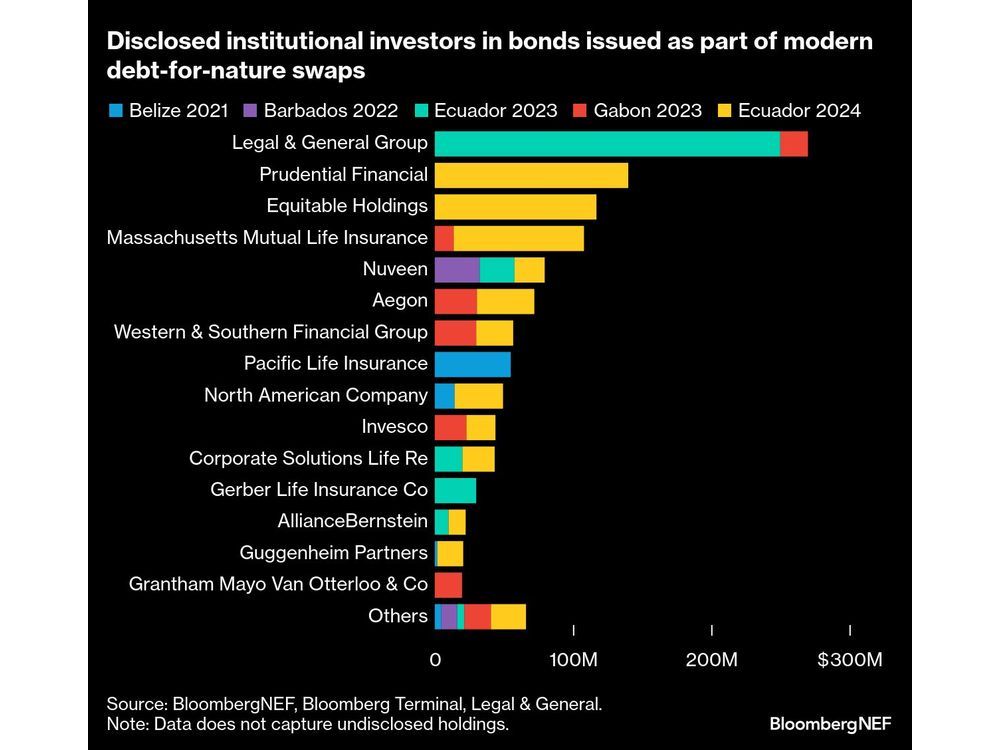

Debt swaps initially developed by Credit Suisse to support nature conservation are experiencing renewed interest as financial institutions look to adapt the model for various global challenges, including post-war reconstruction and energy security. These swaps allow governments to refinance debt under more favorable terms, channeling the savings toward specific policy objectives. Following a period of stagnation in deal-making that began late last year, experts like Jake Harper, senior investment manager at Legal & General Group Plc, predict that as many as four new swaps may be finalized by the end of 2025. Notably, these upcoming deals do not focus on environmental goals.

The evolution of these swaps aligns with a larger trend within the ESG (environmental, social, and governance) investment space. Financial players are increasingly applying the ESG label to initiatives that resonate with current geopolitical circumstances. A prominent example includes efforts by Citigroup Inc. to facilitate funding for the reconstruction of Ukraine following the ongoing conflict.

Antonio Navarro, a former Credit Suisse banker and co-founder of boutique credit fund ArtCap Strategies, emphasizes that the structured nature of debt swaps enables effective responses to political developments. “At the end of the day, these are policy instruments,” he notes. After establishing ArtCap in 2023, the same year Credit Suisse was acquired by UBS Group AG in a state-engineered rescue, Navarro began promoting a swap aimed at enhancing energy security by directing savings into US oil and gas imports and financing liquefied natural gas plants in emerging markets.

Navarro has been engaging with multilateral development banks and the US International Development Finance Corporation (DFC) to advance these proposals. The DFC has offered political risk insurance for over half of the completed debt swap deals thus far. Additionally, the US is a significant stakeholder in many multilateral development banks, which aid in mitigating risks associated with these transactions, making them more attractive for private investors.

The DFC’s involvement is expected to extend to Citigroup’s planned reconstruction swap for Ukraine, which has previously been reported by Bloomberg. The agency is already managing a separate agreement with Ukraine that provides the US with preferential access to new investment projects aimed at developing the country’s natural resources.

Understanding how debt swaps operate is crucial. These deals typically target governments in developing nations seeking to lessen their debt burden in exchange for commitments to sustainable objectives. Existing debt is often repurchased at a discount, funded through the issuance of new bonds or loans. Multilateral development banks frequently participate to provide risk guarantees, thereby reducing the likelihood of losses for private investors and lowering the overall debt cost for borrowing nations.

Concerns have been raised regarding the lack of standardization in reporting fees and savings related to these private deals. Investors interested in this market often prioritize the social and environmental impacts of their contributions. Marine de Bazelaire, former European head of sustainability at HSBC Holdings Plc, warns that borrowing nations should be cautious when entering into debt swap agreements that may cede control over domestic priorities to foreign entities. “At the end of the day, we’re talking about the wealth and real assets of countries and their capacity to monitor what is core to their sovereignty,” she states.

The commercial debt swap market, which has been operational in its current form since 2021, more than doubled in size last year, reaching approximately $4.7 billion. According to a coalition of nonprofits focused on developing nations, this market could potentially unlock up to $100 billion for climate and nature-related goals.

Harper from Legal & General indicates that the new swaps anticipated to finalize later this year will align with non-nature related United Nations Sustainable Development Goals, which encompass areas such as affordable energy and poverty reduction. The Inter-American Development Bank, actively involved in numerous debt swaps to date, is now witnessing increased demand for structures that allocate savings toward education and health initiatives, as noted by its president, Ilan Goldfajn.

The financial framework of debt swaps positions them effectively for environmental projects, asserts Ramzi Issa, co-founder of credit fund Enosis Capital. As the leader of the team that pioneered the swap structure at Credit Suisse, Issa highlights that these instruments provide a consistent cash flow essential for preserving natural ecosystems. He contrasts this with conventional infrastructure financing, which can be managed through standard project finance mechanisms.

Issa cautions that investors traditionally attracted to debt-for-nature swaps may be less inclined to participate in deals lacking clear sustainability objectives. He notes, “The distinguishing factor from other financings is this policy and project component,” which has been a driving force behind investor demand.

According to Daniel Ballesta, executive director at Enosis, swaps targeting new sectors will likely require additional time and resources to adapt. “It’s not just adapting the debt swap to a different sector; you also have to adapt that different sector to the debt swap model,” he explains. This complexity necessitates patient capital and a careful approach.

Harper from Legal & General believes there are no inherent limits on the sectors or purposes to which debt swaps can be applied. He concludes, “The concept should be freely adaptable,” emphasizing the potential for these financial tools to be applied in areas that are structurally underfunded, thereby contributing to broader economic and environmental goals.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Top Stories2 months ago

Top Stories2 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169