Business

China’s Export Restrictions on Rare Earths Impact Global Markets

China has implemented significant export restrictions on rare earth elements, which are essential for a wide range of advanced technologies. This move impacts not only the mining and processing sectors but also various industries, from automotive to defense. The implications for investors and global supply chains are profound, as companies scramble to secure alternative sources.

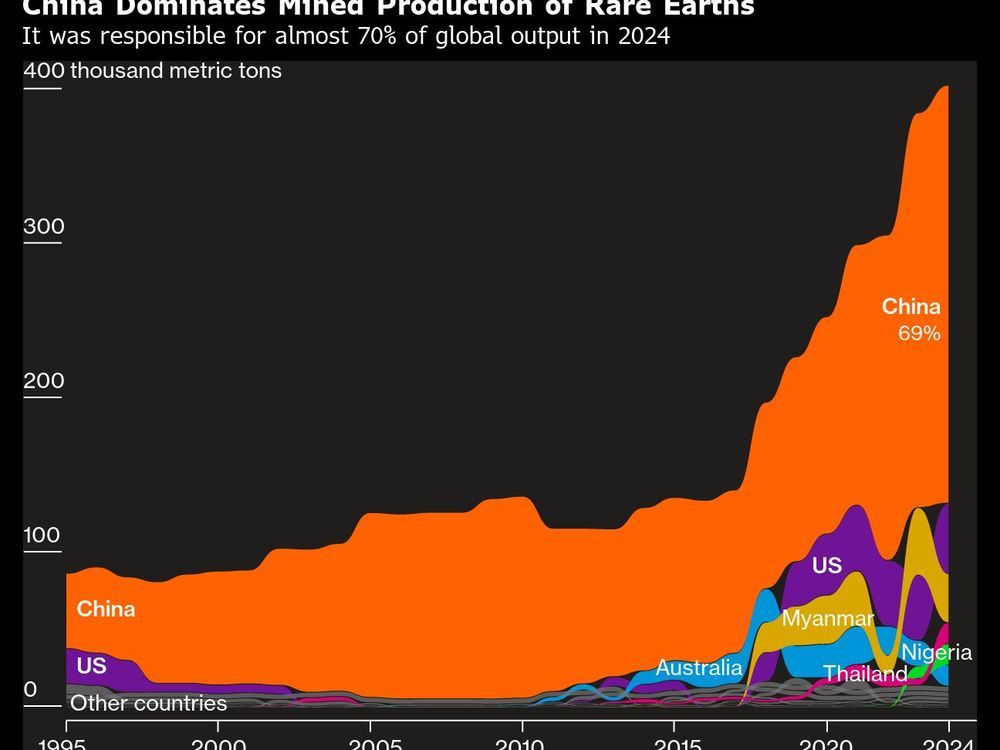

These rare earth elements, including holmium, europium, and thulium, are pivotal in the manufacturing of cutting-edge technology such as weaponry, computer chips, and electric vehicles. China currently dominates this sector, controlling approximately 70% of global mining and nearly 90% of processing capabilities. As a result, the recent restrictions are raising alarms among manufacturers and investors alike.

Global Response and Market Reactions

The restrictions, which are expected to take full effect in December, have sparked a rush for shares in rare earth mining companies outside China. For instance, shares of Lynas Rare Earths Ltd. in Australia have nearly tripled this year, while MP Materials Corp. experienced a surge of over 150% after the US government announced a stake to help expand its production capacity.

Analysts are observing that as the number of rare earths subject to export controls increases, more sectors will be affected. “By increasing the number of rare earths subject to export controls, it’s likely to make the issue relevant to a greater number of sectors,” said Katherine Ogundiya, a thematic investing analyst at Barclays. This situation creates a “security premium” for companies involved in the extraction and processing of these minerals.

In contrast, companies reliant on rare earths, such as Ford Motor Co. and various semiconductor manufacturers, are facing potential disruptions. Ford had to temporarily close a factory in Chicago due to a shortage of rare earth components. This has prompted major automakers like Toyota Motor Corp. and Volkswagen AG to explore alternative technologies that reduce reliance on these critical materials.

Sector-Specific Implications

The semiconductor industry, which has seen a boom due to the rise of artificial intelligence, relies heavily on rare earths for the production of chips. Analysts at Bank of America Corp. point out that while rare earths comprise a small percentage of overall production costs, their absence can severely disrupt operations. Companies like Applied Materials Inc. and Tokyo Electron Ltd. may be affected if supply chains are interrupted.

The defense sector is particularly vulnerable, as rare earths are essential for manufacturing military equipment. For instance, an F-35 fighter jet contains around 900 pounds of rare earth materials. If restrictions block exports to international military users, manufacturers could face significant production hurdles. Jens-Peter Rieck, an analyst at mwb research AG, noted that even a minor shortage can halt production when companies have single suppliers for crucial components.

Automakers are also adapting to the changing landscape. As manufacturers seek to mitigate the effects of China’s restrictions, some are exploring alternatives. For example, General Motors Co. has signed contracts for rare earth magnets from domestic suppliers, including a deal with Noveon Magnetics Inc.. Other companies are investing in technologies that do not require rare earths, such as BMW AG and Renault SA, which are developing electric vehicles that use alternative motor technologies.

In the renewable energy sector, companies are also diversifying their supply chains. Siemens Energy AG has reached an agreement to procure magnets from Japan’s TDK Corp., while Arafura Rare Earths Ltd. supplies essential materials for wind power. Analysts indicate that while the new restrictions may push up prices, the industry has historically adapted well to similar challenges.

As the situation evolves, investors are closely monitoring the market for rare earths and related sectors. The current geopolitical dynamics underscore the importance of securing stable and diverse supply chains. With tensions between the United States and China showing little sign of easing, the ability to navigate these new restrictions will be crucial for companies across multiple industries.

-

Education5 months ago

Education5 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science6 months ago

Science6 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle5 months ago

Lifestyle5 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health6 months ago

Health6 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Education5 months ago

Education5 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Science6 months ago

Science6 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Technology6 months ago

Technology6 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Business2 months ago

Business2 months agoEngineAI Unveils T800 Humanoid Robot, Setting New Industry Standards

-

Technology3 weeks ago

Technology3 weeks agoDigg Relaunches as Founders Kevin Rose and Alexis Ohanian Join Forces

-

Top Stories2 months ago

Top Stories2 months agoCanadiens Eye Elias Pettersson: What It Would Cost to Acquire Him

-

Education6 months ago

Education6 months agoRed River College Launches New Programs to Address Industry Needs

-

Business5 months ago

Business5 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology6 months ago

Technology6 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Education6 months ago

Education6 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Technology4 months ago

Technology4 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Business6 months ago

Business6 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Science6 months ago

Science6 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Lifestyle4 months ago

Lifestyle4 months agoCanadian Author Secures Funding to Write Book Without Financial Strain

-

Business6 months ago

Business6 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business1 month ago

Business1 month agoNvidia and AMD CEOs Unveil AI Innovations at CES 2026

-

Business4 months ago

Business4 months agoHydro-Québec Espionage Trial Exposes Internal Oversight Failures

-

Top Stories4 months ago

Top Stories4 months agoPatrik Laine Struggles to Make Impact for Canadiens Early Season

-

Business6 months ago

Business6 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology6 months ago

Technology6 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase