Business

Botswana Faces Economic Crisis as Lab-Grown Diamonds Surge

Botswana is grappling with a profound economic crisis as the rise of lab-grown diamonds threatens the nation’s traditional diamond industry. Once celebrated for its wealth generated from natural diamonds, the country is now witnessing a drastic decline in revenue, prompting widespread social unrest and economic instability.

In recent months, long queues have formed outside government clinics, construction companies reliant on state contracts have begun laying off workers, and university students are threatening to boycott classes over unfulfilled allowance increases. This downturn starkly contrasts with a few years ago when Botswana, home to approximately 2.5 million people, thrived economically due to its substantial diamond reserves. The nation had invested heavily in healthcare and education, setting a benchmark for others in southern Africa.

The discovery of diamonds in 1967 marked a transformative period for Botswana. At the time of its independence from the UK, the nation was a rural backwater with limited infrastructure. Over the last six decades, the diamond industry propelled Botswana to become the richest nation per capita in sub-Saharan Africa. However, this dependence on a single commodity has now become a cautionary tale.

In an August speech, President Duma Boko addressed the situation, stating, “For decades, we have leaned and relied heavily on diamonds. While they served us well, we know painfully today that this model has reached its limits.” He emphasized that the economic crisis represents not just a financial challenge but a “national social existential threat.”

The diamond market is currently in turmoil, largely due to the increasing popularity of lab-grown diamonds, particularly in the United States, which is the largest market for such gems. According to jewelry insurer BriteCo Inc., lab-grown diamonds made up nearly half of all engagement ring purchases in the previous year, a significant rise from just 5% in 2019. The collapse of the luxury retail sector in China and the repercussions of US tariffs have further exacerbated challenges faced by the diamond industry.

Natural diamonds, formed over billions of years under extreme conditions, are being undercut by lab-grown alternatives produced in a matter of weeks. The shift is causing significant disruption, with mining historian Duncan Money noting that this is the most significant market shift since alluvial diamonds were discovered on Namibia’s beaches, leading to a price drop.

Botswana’s economy is heavily reliant on diamond revenue, which represents approximately 80% of its exports and a third of government income. Following repeated write-downs, Anglo American Plc is now seeking to sell De Beers, the world’s largest diamond company, which operates almost all of Botswana’s diamond mines in partnership with the government.

In response to this crisis, President Boko’s administration has sought guidance from Malaysia’s PEMANDU Associates to expedite economic diversification. On August 21, Boko announced a plan for Qatari investment group Al Mansour Holdings to inject $12 billion into the economy. However, details on the investment’s deployment remain scarce, raising concerns about the credibility of such promises.

The situation in Botswana has deteriorated to the point where a public health emergency was declared on August 25. The president urged pension funds and insurers to assist in funding the healthcare response, as shortages of medication and medical supplies have surfaced. According to Kefilwe Selema, president of the Botswana Doctors Union, the healthcare system is under severe strain, with patients like Galeemiswe Mosheti facing extended wait times for treatment.

Construction companies are also feeling the impact, with many members of the Tshipidi Badiri Builders Association forced to retrench workers due to reduced government spending. Chairman Tshotlego Kagiso reported that many firms have suspended operations, resulting in significant job losses.

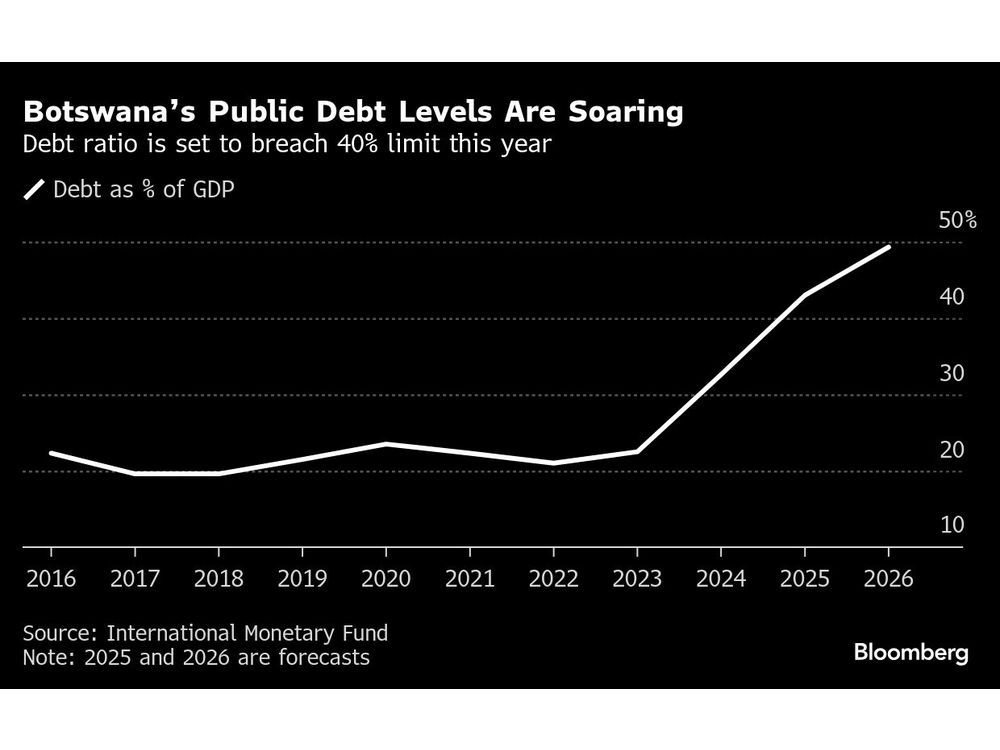

Economic indicators reflect a troubling trend, as the International Monetary Fund forecasts Botswana’s fiscal deficit will rise to 11% of GDP by 2025, the largest budget gap since the global financial crisis in 2009. The finance ministry recently revised its growth forecasts, now predicting a contraction of 0.4% instead of a growth of 3.3%. Foreign reserves have plummeted by 27% over the past year, and Citigroup has warned that continued devaluation of the pula, Botswana’s currency, may be necessary.

The government has begun turning to debt as a solution, securing $304 million from the African Development Bank in May and $200 million from the OPEC fund in July. Plans for a domestic bond roadshow are also underway, as the nation seeks to navigate its financial challenges.

Both Moody’s and S&P Global Ratings have downgraded Botswana’s credit outlook to negative, putting its investment-grade rating at risk. “The diamond sector is under severe pressure — both prices and volumes,” noted Ravi Bhatia, a lead analyst at S&P Global Ratings.

Despite efforts to diversify the economy, progress has been limited. Tourism, while the second-largest sector after diamonds, only contributes 12% to GDP. Initiatives to develop copper mining and exploit coal deposits have not gained sufficient traction to offset the downturn.

With the youth unemployment rate exceeding 40%, the urgency for job creation is palpable. President Boko has articulated a vision for future investments in renewable energy, technology, and agriculture. Yet, the ongoing economic decline has left little room for the funding needed to realize these ambitions.

As Botswana navigates these turbulent times, it faces a daunting challenge in redefining its economic landscape and reducing reliance on diamonds. The outlook remains uncertain, with many questioning whether the nation can adapt and thrive in a rapidly changing global market.

-

Education3 months ago

Education3 months agoBrandon University’s Failed $5 Million Project Sparks Oversight Review

-

Science4 months ago

Science4 months agoMicrosoft Confirms U.S. Law Overrules Canadian Data Sovereignty

-

Lifestyle3 months ago

Lifestyle3 months agoWinnipeg Celebrates Culinary Creativity During Le Burger Week 2025

-

Health4 months ago

Health4 months agoMontreal’s Groupe Marcelle Leads Canadian Cosmetic Industry Growth

-

Technology3 months ago

Technology3 months agoDragon Ball: Sparking! Zero Launching on Switch and Switch 2 This November

-

Science4 months ago

Science4 months agoTech Innovator Amandipp Singh Transforms Hiring for Disabled

-

Education3 months ago

Education3 months agoRed River College Launches New Programs to Address Industry Needs

-

Technology4 months ago

Technology4 months agoGoogle Pixel 10 Pro Fold Specs Unveiled Ahead of Launch

-

Business3 months ago

Business3 months agoRocket Lab Reports Strong Q2 2025 Revenue Growth and Future Plans

-

Technology2 months ago

Technology2 months agoDiscord Faces Serious Security Breach Affecting Millions

-

Education3 months ago

Education3 months agoAlberta Teachers’ Strike: Potential Impacts on Students and Families

-

Science3 months ago

Science3 months agoChina’s Wukong Spacesuit Sets New Standard for AI in Space

-

Education3 months ago

Education3 months agoNew SĆIȺNEW̱ SṮEȽIṮḴEȽ Elementary Opens in Langford for 2025/2026 Year

-

Technology4 months ago

Technology4 months agoWorld of Warcraft Players Buzz Over 19-Quest Bee Challenge

-

Business4 months ago

Business4 months agoNew Estimates Reveal ChatGPT-5 Energy Use Could Soar

-

Business3 months ago

Business3 months agoDawson City Residents Rally Around Buy Canadian Movement

-

Technology2 months ago

Technology2 months agoHuawei MatePad 12X Redefines Tablet Experience for Professionals

-

Business3 months ago

Business3 months agoBNA Brewing to Open New Bowling Alley in Downtown Penticton

-

Technology4 months ago

Technology4 months agoFuture Entertainment Launches DDoD with Gameplay Trailer Showcase

-

Technology4 months ago

Technology4 months agoGlobal Launch of Ragnarok M: Classic Set for September 3, 2025

-

Technology4 months ago

Technology4 months agoInnovative 140W GaN Travel Adapter Combines Power and Convenience

-

Science4 months ago

Science4 months agoXi Labs Innovates with New AI Operating System Set for 2025 Launch

-

Top Stories2 months ago

Top Stories2 months agoBlue Jays Shift José Berríos to Bullpen Ahead of Playoffs

-

Technology4 months ago

Technology4 months agoNew IDR01 Smart Ring Offers Advanced Sports Tracking for $169